VA Guidelines After Bankruptcy And Foreclosure On VA Home Loans

This guide will cover VA guidelines after bankruptcy and foreclosure on VA loans. VA loans are the best home mortgage loan program available today. Dale Elenteny of Non-QM Mortgage Brokers is an expert on VA loans and has done countless VA manual underwriting VA loans with credit scores down to 500 FICO and debt-to-income ratios as high as 63% DTI. Here is what Dale Elenteny said on VA loans:

Rates are lower than conventional loans. Eligible borrowers can qualify for a VA loan with 100% financing, no mortgage insurance, no maximum loan limit, and lenient agency mortgage requirements.

VA loans have no minimum credit score requirements or maximum debt-to-income ratio caps. This holds true as long as the borrower can get approve/eligible per the automated underwriting system. Borrowers can qualify for a VA loan two years after Chapter 7 Bankruptcy discharge. There is also a two-year waiting period after a foreclosure, deed-in-lieu of foreclosure, or short sale to become eligible to qualify for a VA loan.

VA Guidelines During Chapter 13 Bankruptcy

Borrowers in an active Chapter 13 Bankruptcy can qualify for a VA loan one year into the Chapter 13 Bankruptcy repayment plan. Chapter 13 Bankruptcy does not have to be discharged. Veterans can qualify for a VA loan with a higher than 60% debt-to-income ratio. VA loans allow manual underwriting with a debt-to-income ratio higher than 60% as long as the borrower has strong residual income.

VA and FHA loans are the only two mortgage loan program that allow borrowers in an active Chapter 13 Bankruptcy repayment plan to qualify for a home mortgage without the Chapter 13 Bankruptcy being discharged. You are eligible to qualify for an FHA or VA loan after 12 months of filing Chapter 13 Bankruptcy and making 12 timely payments to the Bankruptcy Trustee.

There is no waiting period after the Chapter 13 Bankruptcy discharge date to qualify for a VA loan. Non-QM Mortgage Brokers is one of the country’s most aggressive VA mortgage companies with no lender overlays. This article will cover qualifying for a VA loan after bankruptcy and foreclosure at Non-QM Mortgage Brokers.

What Are The New 2023 VA Guidelines After Bankruptcy and Foreclosure

VA loans only have a two-year mandatory waiting period after foreclosure, deed-in-lieu of foreclosure, or short sale for a Veteran to qualify for a VA loan. FHA loans require a three-year waiting period for a home buyer to qualify for an FHA loan after a foreclosure, deed-in-lieu of foreclosure, or short sale.

Over 80% of our clients at Non-QM Mortgage Brokers are borrowers who could not qualify at other mortgage companies due to lender overlays or because the lender did not have the mortgage loan option best suited for the borrower.

Fannie Mae and Freddie Mac have a 7-year mandatory waiting period for borrowers to qualify for a Conventional loan. Fannie Mae and Freddie Mac require a four-year mandatory waiting period for a borrower to qualify for a Conventional mortgage after a deed-in-lieu of foreclosure or short sale.

Best Lender With No Overlays on VA Guidelines After Bankruptcy

If you are a Veteran and would like to see if you qualify for a VA loan, contact us at Non-QM Mortgage Brokers at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.

Non-QM Mortgage Brokers are mortgage lenders licensed in 48 states, including Washington, DC, Puerto Rico, and the U.S. Virgin Islands.

Non-QM Mortgage Brokers have non-QM loans one day out of bankruptcy or foreclosure for borrowers with no waiting period requirements. However, a 30% down payment is required. The team at Non-Qm Mortgage Brokers is available seven days a week, evenings, weekends, and holidays to take your phone calls and answer any questions on VA loans.

Every mortgage loan program has a mandatory waiting period after bankruptcy and foreclosure. Alex Carlucci of Non-QM Mortgage Brokers has helped hundreds of veterans qualify for VA loans with credit scores down to 500 FICO. Here is what Alex said about qualifying for VA loans after filing Chapter 13 Bankruptcy:

Many folks who go through bankruptcy and foreclosure think they are doomed and will never be able to obtain credit. A bankruptcy or foreclosure or both does not deter a home buyer from buying and becoming a homeowner again.

When you file Chapter 13 Bankruptcy and apply for a home loan, you will notice a massive drop in your credit scores. The big drop in the consumer’s credit scores after bankruptcy is temporary.

Can I Qualify For VA Loans With Low Credit Scores?

Yes, a consumer’s credit score can plummet by more than 100 points after they file bankruptcy or have a foreclosure reported on their credit report. As the Chapter 13 Bankruptcy age on the consumer’s credit report, the less impact it will have on their credit scores.

Homebuyers can qualify for VA and FHA loans one year into an active Chapter 13 Bankruptcy repayment plan after they have made 12 timely payments with no late payments. The minimum credit score requirements to be eligible for FHA or VA loans during Chapter 13 Bankruptcy repayment plan is 500 FICO.

Consumer credit scores will gradually increase over time. This still holds true even though the consumer does nothing to their credit. Homebuyers can expedite and boost their credit scores after bankruptcy or foreclosure if they start re-establishing their credit. How can you re-establish credit when your credit has plummeted over 150 FICO points after bankruptcy and foreclosure? Read on!!! This article will discuss and cover VA guidelines after bankruptcy and foreclosure on VA loans.

VA Guidelines After Bankruptcy and Foreclosure and Re-Establishing Credit

As mentioned in the earlier paragraph, credit scores will plummet triple digits after bankruptcy and foreclosure are reported on the credit report.

Many consumers with a recent bankruptcy and foreclosure give up on getting credit. Many want to pay cash for all of their purchases. They do not believe that they can re-establish their credit because of their low credit scores and the recent bankruptcy and foreclosure that is reported on their credit report.

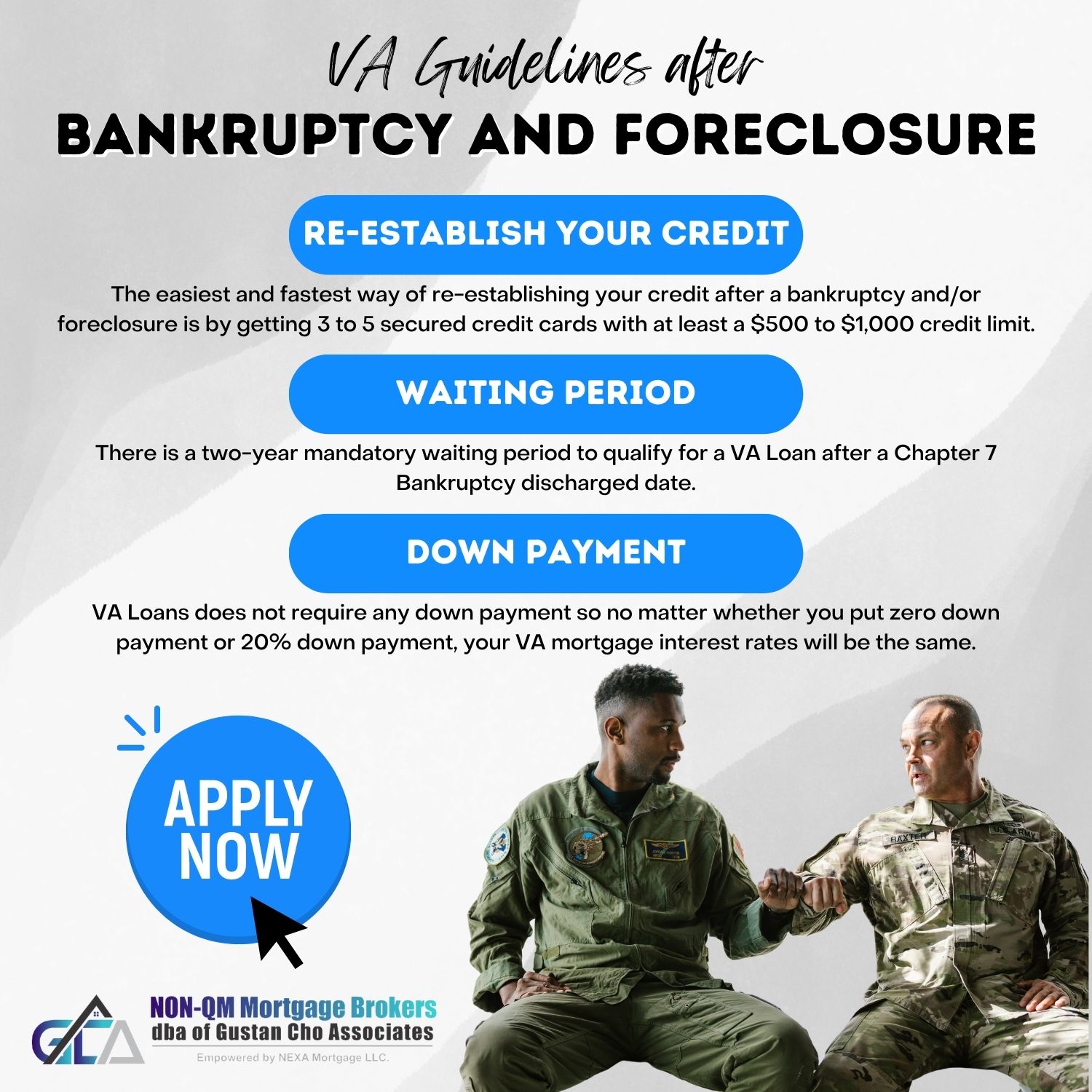

Consumers can re-establish credit right after bankruptcy and foreclosure. The easiest and fastest way of re-establishing your credit after bankruptcy and foreclosure is by getting 3 to 5 secured credit cards with at least a $500 to $1,000 credit limit.

Using Secured Credit Cards To Boost and Re-Establish Credit

The higher the credit limit secured credit card consumers get, the stronger their credit profile will be. As the secured credit card ages, the stronger the credit profile will be and the higher the credit scores will be.

I have seen people have 700 plus FICO credit scores one year after a Chapter 7 Bankruptcy, foreclosure, deed-in-lieu of foreclosure, and short sale. This was done just by getting several secured credit cards and other credit.

Keep your credit card balances low and always pay your minimum payments on time. Secured credit card companies will report late payments to the three credit bureaus. One late payment will not just plummet consumer credit scores but will remain on your credit report for seven years.

VA Guidelines After Bankruptcy and Foreclosure on Waiting Period After Chapters 7 and 13

In this blog, we will cover the mandatory waiting period after bankruptcy for FHA, Conventional, and VA loans. There is a mandatory waiting period of two years to qualify for an FHA loan after a Chapter 7 Bankruptcy discharge date. A four-year mandatory waiting period is required to qualify for a Conventional loan after a Chapter 7 Bankruptcy discharge date.

Over 30% of our borrowers are folks in a Chapter 13 Bankruptcy Repayment Plan or recent Chapter 13 discharge who must qualify for VA or FHA loans.

Non-QM Mortgage Brokers have non-QM loans one day out of bankruptcy or foreclosure with no waiting period requirements. Non-QM mortgages one day out of bankruptcy or foreclosure require a 20% to 30% down payment, and rates are generally higher. There is no pre-payment penalty, so borrowers can refinance once they meet the waiting period requirements on government and conventional loans.

What Are The Waiting Period Guidelines After Bankruptcy on Government and Conventional Loans

A two-year mandatory waiting period to qualify for a VA loan after a Chapter 7 Bankruptcy discharge date. The waiting period is three years after the Chapter 7 discharge date to qualify for USDA loans.

Whether you put a zero down payment or a 20% down payment, your VA mortgage interest rates will be the same.

Borrowers can qualify for VA loans one year into their Chapter 7 Bankruptcy Repayment Plans. There is also no waiting period after the Chapter 7 Bankruptcy discharge date at Non-QM Mortgage Brokers. It needs to be a manual underwrite.

How Does Bankruptcy and Housing Event Affect Mortgage Rates

A previous Chapter 7 Bankruptcy will not affect your mortgage interest rates on your VA loan. The only thing that will affect your mortgage interest rates on your VA loan is your credit score.

VA loans do not require any down payment. The loan-to-value on VA loans does not affect your mortgage rates. This is due to the government guarantee on VA loans.

The loan-to-value does not impact VA mortgage interest rates because the United States Department of Veteran Affairs insures VA loans.

Government Guarantee on VA Loans

The Department of Veterans Affairs is like FHA loans insured by the Federal Housing Administration. Conventional loans are not insured. VA loans have the best rates and terms of any other mortgage loan program nationwide.

VA loans are one of three government loan programs for owner-occupant homes. There is no monthly mortgage insurance premium on VA loans. There is no maximum loan limit cap on VA loans.

Borrowers with less than a 20% down payment must get private mortgage insurance from a private mortgage provider. With Conventional loans, the more down payment a homebuyer puts down on their home purchase, the lower the mortgage interest rates are.

VA Guidelines on Waiting Period After Foreclosure

VA loans only have a two-year mandatory waiting period after foreclosure, deed-in-lieu of foreclosure, or short sale for a Veteran to qualify for a VA loan. FHA loans require a three-year waiting period for a home buyer to qualify for an FHA loan after a foreclosure, deed-in-lieu of foreclosure, or short sale.

Over 80% of our clients at Non-QM Mortgage Brokers are borrowers who could not qualify at other mortgage companies due to lender overlays or because the lender did not have the mortgage loan option best suited for the borrower.

Fannie Mae and Freddie Mac have a 7-year mandatory waiting period for borrowers to qualify for a Conventional loan. Fannie Mae and Freddie Mac require a four-year mandatory waiting period for a borrower to qualify for a Conventional mortgage after a deed-in-lieu of foreclosure or short sale.

Best Lender With No Overlays on VA Guidelines After Bankruptcy

If you are a Veteran and would like to see if you qualify for a VA loan, contact us at Non-QM Mortgage Brokers at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.

Non-QM Mortgage Brokers are mortgage lenders licensed in 48 states, including Washington, DC, Puerto Rico, and the U.S. Virgin Islands.

Non-QM Mortgage Brokers have non-QM loans one day out of bankruptcy or foreclosure for borrowers with no waiting period requirements. However, a 30% down payment is required. The team at Non-Qm Mortgage Brokers is available seven days a week, evenings, weekends, and holidays to take your phone calls and answer any questions on VA loans.