Cost of Home Ownership Versus Renting

In this article, we will cover and discuss the true cost of home ownership and compare the cost of a homeowner versus a renter. We will cover the frequently asked questions by first-time homebuyers with concerns about becoming a homeowner. We will discuss the finances and credit required to buy a house. We will also cover the cost of home ownership, including the down payment and closing cost requirements.

What Are The Cost of Home Ownership, Including Expenses?

Many people are under the assumption you need perfect credit and a 20% down payment plus thousands of dollars in closing costs. Most folks do not have a 20% down payment and additional money for closing costs on an average home in a subdivision.

The team at Non-QM Mortgage Brokers has helped thousands of families qualify and obtain a home mortgage to own their very own home.

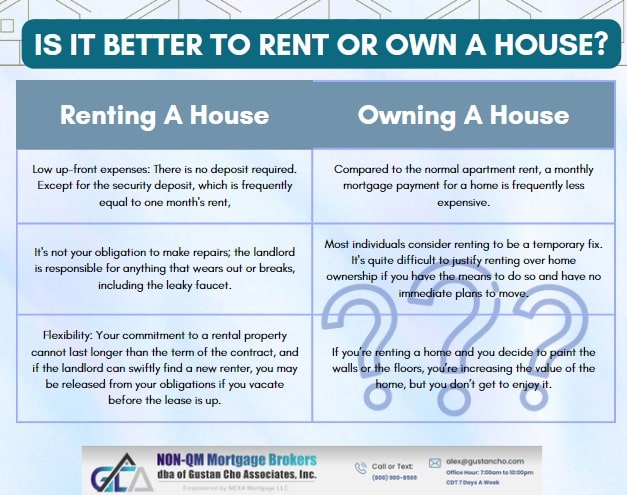

Is It Better To Rent or Own a House?

Owning your own home is still the American Dream for most Americans. The advantages of being a homeowner far surpass being a renter. However, first-time home buyers need to consider the cost of homeownership before they pull the plug on being a homeowner versus a renter. In the following sections of this blog, we will break down the homebuying and mortgage process step by step. We will also touch on the various mortgage loan options you may want to explore and research.

The Rewards and Cost of Home Ownership

Homeownership offers many benefits, such as the following:

- the pride of being a homeowner

- likelihood of home appreciation

- building equity

- security of being able to stay at home without being told what to do by the landlord

- The landlord is not renewing the lease and needs to move

- being able to decorate the home the way the homeowner likes without getting landlord approval

- being able to adopt pets without landlord approval and without putting up additional security deposits

Homeowners do not have to not worry about rental payments increasing year after year.

The Cost of Home Ownership Versus Paying Rent

Many times, new mortgage payments as a homeowner may even be less than the current rental payments renters pay. The real estate market is hot throughout the country. According to dually licensed realtor/loan officer Zack “Hunter” Hoyer of Non-QM Mortgage Brokers, home prices are still skyrocketing despite historically high rates:

In some areas of the nation, housing prices are appreciating by 10% yearly due to the demand of more homebuyers than the number of housing inventory.

This holds true, especially in many counties throughout the United States, such as California, Texas, Florida, Georgia, Colorado, Illinois, New Jersey, Michigan, and Pennsylvania, Utah was specifically affected. Homeowners who purchased their homes several years ago are sitting on equity in their homes.

The Down Payment and Closing Costs on a Home Purchase

The home purchase transaction’s down payment and closing costs can be 100% gifted by a family member. Most homebuyers do not have to worry about closing costs. This is because a realtor can negotiate that the home seller pays the closing costs with a seller concession toward a home buyer’s closing costs. Lenders can offer lenders credit toward closing costs if the home seller only gives a limited amount or no seller concessions.

3% First-Time Homebuyer Down Payment on Conventional Loans

Fannie Mae has reinstituted the 3% down payment conventional loan program for first-time home buyers. Fannie Mae instituted the 3% down payment conventional loan program for first-time home buyers to compete with FHA’s 3.5% down payment requirement. With seller concessions, homebuyers who qualify for VA and USDA loans can become homeowners with zero dollars out of their pocket.

Are Reserves Required By Lenders

Sometimes, lenders will require reserves for mortgage loan applicants with lower credit scores, no rental verification, poor credit, or short-term on the job. Automated Underwriting System will state on AUS Findings if borrowers need reserves. All manual underwriting needs one month’s reserves.

What Are Reserves In Mortgage Loans

Reserves are one month’s principal, interest, taxes, and insurance. Reserves are one month of principal, interest, taxes, and insurance. Most mortgage loan applicants with credit scores higher than 620 will not be required to have reserves. However, reserves are recommended for all homeowners. Reserves are strongly recommended to all homeowners if something needs fixing, such as if the furnace goes out, the air conditioning, or the appliance breakdowns.

Potential High-Cost Repairs For Homeowners

For example, homeowners who live in states with severe winter weather, what would they do if the furnace breaks down during sub-zero weather? Homeowners would have to fix it or replace it right away. Replacing a furnace can run a couple of thousand dollars. The heating system has broken down, we need to have the furnace replaced as soon as possible, or the pipes will freeze.

Replacing Appliances Needing Repairs

How about if the refrigerator or freezer breaks down and needs to replace it? Many homeowners have separate freezers that stock hundreds of dollars worth of perishable foods. Replacing refrigerators and freezers is a high-ticket item. There are costs of homeownership, and sometimes these costs can be quite expensive. Reserves are highly recommended even if the lender does not require them.

Additional Cost of Home Ownership

There are so many benefits to homeownership. However, homebuyers should keep the cost of homeownership in mind when buying a home. They should make sure that they do not buy too many houses. The larger a home is, the more expenses there will be. Electric and gas prices constantly go up year after year, which can cost several hundred dollars during the severe winter months. Electric bills can run extremely high during the hot summer monthsThe larger the home is, the higher the utility bills will be.

Cost of Home Ownership With Maintenance and Repair For Homeowners

There is also the cost of lawn maintenance and snow plowing service during winter. There are instances and cases where appliances break down or HVAC systems malfunction. Homes will need short-term as well as long-term maintenance and homes do need repairs. Repairs can be minor repairs. Major repairs may be needed as well. A responsible homeowner should also set aside a portion of their monthly income into a homeowner’s repair fund.

Upfront and Regular Cost of Home Ownership

Non-Qm Mortgage Brokers have a national reputation for being able to close home loans other mortgage companies cannot. Licensed in 48 states, including DC, Puerto Rico, and the U.S. Virgin Islands, Non-QM Mortgage Brokers has a national reputation for being a one-stop mortgage shop. Zack “Hunter” Hoyer, a dually licensed realtor/loan officer explains the following:

Non-QM Mortgage Brokers has a network of over 210 wholesale mortgage lenders, including no overlay government and conventional mortgage lenders, non-QM and alternative wholesale lenders, niche mortgage lenders, and every mortgage loan program in the marketplace.

Non-QM Mortgage Brokers has a national five-star national reputation for its no overlays on government and conventional loans business models. The team at Non-QM Mortgage Brokers is available seven days a week, on evenings, weekends, and holidays and can be contacted at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Non-QM Mortgage Brokers is available seven days a week, on evenings, weekends, and holidays.