Non-QM Loans One Day Out of Bankruptcy

In this blog, we will cover non-QM loans one day out of bankruptcy with no waiting period requirements. After the great recession the mortgage industry introduced stringent measures on mortgage lending by tightening the lending standards to avoid another subprime mortgage crisis. To the lenders, this was a positive development because they could thoroughly check and evaluate a borrower’s ability to repay a loan before issuing it. Many homebuyers often recover sooner than others so they can qualify for non-QM loans one day out of bankruptcy with a 20% down payment.

This drastically reduces the possibility of loan defaults, which hurts lenders. Nevertheless, the stringent guidelines made many more borrowers ineligible for a mortgage, such as self-employed or gig workers, who only meet some of the requirements of traditional loans, even though they can repay the loan. In the following paragraphs, we will discuss non-QM loans one day out of bankruptcy.

How Long After Bankruptcy Discharge Can I Get Mortgage?

Now, regarding requirements, conventional mortgages need one to have to wait for several months after bankruptcy following a declaration before applying for one. Under these circumstances, many formerly qualified individuals were turned back. The good news is that there is still hope! Now that you’ve had your bankruptcy discharged, you’ll likely qualify for a mortgage of a type known as Non-QM loans. Here, we intend to tell you about Non-QM mortgages and what they entail, along with how you can apply even though you had a day in bankruptcy. So read on to learn more.

What Is a Non-QM Mortgage?

To understand a Non-QM loan, you first need to know what a QM or a qualified mortgage is. So, QM mortgages represent a category of loans created by the Consumer Financial Protection Bureau (CFPB) and have been designed to make borrowers less likely to default on them. What we mean by this is that they come with stricter regulations that enable the lender to evaluate whether a borrower can afford the mortgage fully.

So, for instance, you are required to have a debt-to-income ratio at a certain threshold, specific types of documents to verify your income, and a decent credit score. If you had been declared bankrupt, you must wait for four years from the date you filed and two years from the date the court dismissed your bankruptcy.

How Does Non-QM Mortgages Work?

With that said, a Non-QM mortgage is a loan that doesn’t necessarily need to meet all the requirements of a QM mortgage. Typically, they are loans for borrowers with unique circumstances or those who don’t qualify for QM loans. We are talking of self-employed individuals, those with fluctuating incomes, contractors, artists, entrepreneurs, or independent business owners. Non-QM loans are becoming increasingly popular as an alternative to traditional mortgage lending because these loans, which the government does not back, allow borrowers who may have experienced bankruptcy to qualify for a loan within one day of filing.

Non-QM Loans For Bad Credit

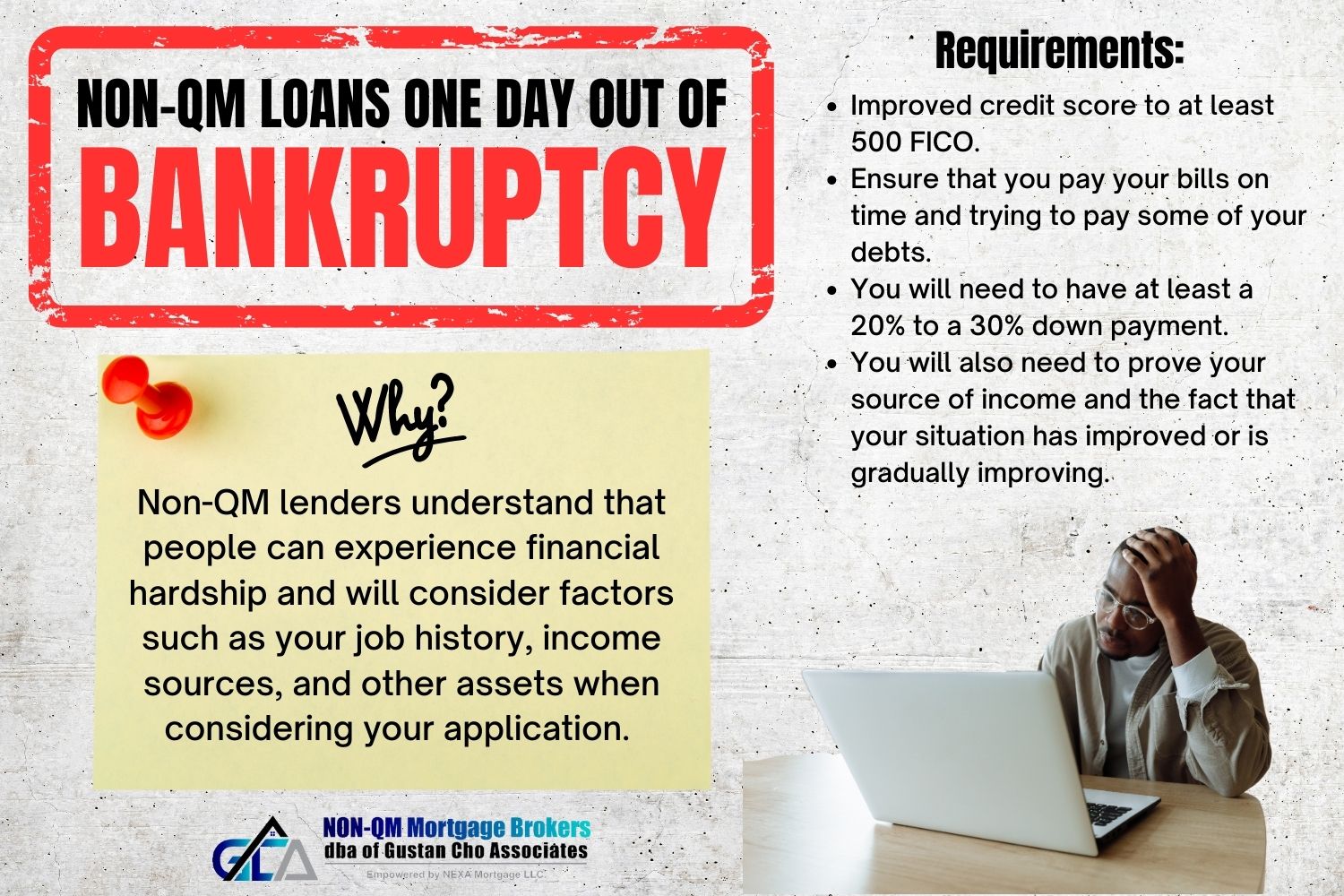

For those with poor or bad credit scores and limited income documentation, Non-QM loans offer more flexible guidelines than traditional mortgages do. This type of loan is ideal for someone who has recently filed for bankruptcy but needs help financing their next home purchase quickly. Non-QM lenders understand that people can experience financial hardship and will consider factors such as your job history, income sources, and other assets when considering your application.

Unlike traditional mortgages, these loans don’t require lengthy approval processes or rigorous qualifications. Instead, they focus on helping borrowers get back on their feet financially after experiencing hard times. Homebuyers can now qualify for non-QM loans one day out of bankruptcy with no maximum loan limit.

Getting a Non-QM Loans One Day Out of Bankruptcy

Filing for bankruptcy isn’t a permanent mark on your credit score; after taking specific steps, you may qualify for a mortgage. The first thing that needs to happen is for the court to dismiss your bankruptcy. The other thing you need to do is to ensure that you make your payments on time after the dismissal. Also, it would be best if you started saving money and living on a budget. Unlike conventional mortgages, where one has to wait for at least two years after bankruptcy dismissal to be eligible for a mortgage, Non-QMs will take you only a short time. Non-QMs don’t have a waiting period requirement after bankruptcy.

How Can I Get Approved For Non-QM Loans One Day Out of Bankruptcy?

When you file for bankruptcy, your credit scores are significantly affected – it drops significantly. And that dents your ability to qualify for a loan shortly. However, as we mentioned earlier, after some time, if the bankruptcy was to get dismissed and you start building on your credit diligently, you will certainly qualify for a conventional mortgage after two years after the date of dismissal. Non-QM Mortgage Brokers has dozens of lending partnerships with 190 wholesale non-QM mortgage lenders. The team at Non-QM Mortgage Brokers are experts in originating and closing non-QM and alternative loan programs.

When you file for bankruptcy, your credit scores are significantly affected – it drops significantly. And that dents your ability to qualify for a loan shortly. However, as we mentioned earlier, after some time, if the bankruptcy was to get dismissed and you start building on your credit diligently, you will certainly qualify for a conventional mortgage after two years after the date of dismissal. Non-QM Mortgage Brokers has dozens of lending partnerships with 190 wholesale non-QM mortgage lenders. The team at Non-QM Mortgage Brokers are experts in originating and closing non-QM and alternative loan programs.

What Are The Eligibility Requirements on Non-QM Loans One Day Out of Bankruptcy

The million-dollar questions are, what if I don’t want to wait for that long? There is no waiting period after bankruptcy with non-QM loans one day out of bankruptcy. What if I have recovered financially and can afford a mortgage but don’t want to wait? This is where Non-QM loans come in. These mortgages are not subjected to the waiting period conventional loans are subjected to, as they are designed to cater to borrowers who can’t meet the requirements for the QM loans. But you might still ask, how long after the dismissal can I qualify for the Non-QM loan? Or, even more direct, can I qualify for the Non-QM loan a day after the dismissal? The answer is a resounding yes!

Can I Qualify For Non-QM Loans One Day Out of Bankruptcy Dismissal?

Non-QM loans one day out of bankruptcy has no waiting period after bankruptcy discharge and dismissal. Many Non-QM mortgage lenders offer these loans to borrowers whose bankruptcy report has just been dismissed in a court. By the time your bankruptcy status is dismissed, you most likely have started saving money, living on a budget, paying your bills on time, and even probably secured a source of income.

So, your situation has significantly improved, and it’s this improvement that the Non-QM loan lender will focus on before qualifying you for a mortgage. Here are some of the other requirements you will need to meet before you become eligible for the loan:

- To qualify for non-QM loans one day out of bankruptcy, you will need to have improved your credit score to at least 500 FICO.

- You will achieve this by ensuring you pay your bills on time and trying to pay some of your debts.

- You will need to have at least a 20% to a 30% down payment.

- You will also need to prove your source of income and the fact that your situation has improved or is gradually improving.

It would be best if you remembered that while it is easy to access Non-QM loans one day out of bankruptcy, they come with higher interest rates. This is meant to protect the lender should you default on the loan.

Best Mortgage Lenders For Non-QM Loans One Day Out of Bankruptcy

Without a doubt, Non-QM loans are the fastest-growing loan program in the country, and the fact that one can qualify even a day after bankruptcy increases its popularity even further. Remember that Non-QM is an umbrella term for mortgages that fall outside qualified mortgage guidelines. There are a number of loans under it, including bank statement loans, foreign national programs, investor cash flow programs, etc.

Even though these loans may be expensive compared to conventional ones, if you think of the risk, the lender assumes and the fact that you are taking up a loan just a day after bankruptcy, you will completely understand. Therefore, consult with a reputable Non-QM mortgage broker, who will support you and answer your questions regarding your particular situation. Homebuyers can qualify for non-QM loans one day out of bankruptcy with no mortgage insurance and no maximum loan limit.

This blog on Non-QM Loans One Day Out of Bankruptcy Was updated on December 24th, 2022