Non-QM Loans One Day Out of Foreclosure

In this blog, we will cover non-QM loans one day out of foreclosure mortgage guidelines. Losing your home through foreclosure can be quite difficult and can seriously affect you, both emotionally and financially. But truth be told, the fact that you lost your home in this manner doesn’t ground or limit you to renting for the rest of your life. After some time, the impacts of the foreclosure will lessen gradually, especially as your financial situation improves, and eventually, it will drop off your credit report.

The housing market in the nation has been bullish for the past several years. Just the past two years, home prices have increased almost fifty percent. Without non-QM loans one day out of foreclosure and bankruptcy, you could have missed the opportunity to be able to own a home. Now, with non-QM loans one day out of foreclosure, you do not have to wait the two to seven year waiting period requirement mandated by FHA, VA, USDA, Fannie Mae, and Freddie Mac.

What Are Non-QM Loans One Day Out of Foreclosure

Non-QM loans one day out of foreclosure are portfolio loans that do not require mandatory waiting period after a housing event. Portfolio loans are mortgage loans originated and funded by non-QM wholesale mortgage lenders. Once the mortgage is funded, it is either held by the lender or sold to institutional investors such as insurance companies, hedge funds, or money managers. Government and conventional loans are originated and funded by private lenders. Government and conventional loans are sold on the secondary market to other larger mortgage bankers or directly to Fannie Mae and Freddie Mac.

What Is The Role of Fannie Mae and Freddie Mac in The Housing Market?

Fannie Mae and Freddie Mac are the largest government-sponsored enterprises (GSE) and biggest buyers of mortgage-backed securities. The role of Fannie Mae and Freddie Mac is to stabilize the secondary mortgage markets so lenders can sell the loans they fund and repeat funding more mortgage loans. Government loans are FHA, VA, and USDA loans.

Fannie Mae and Freddie Mac buys mortgages from mortgage bankers that only conform to Fannie Mae and Freddie Mac conforming lending guidelines. If the mortgage does not conform to Fannie Mae and Freddie Mac guidelines, it is called non-conforming loans or non-Qualified mortgages. Non-Qualified mortgages are often referred to non-QM loans or non-QM mortgages.

Waiting Period Guidelines on Government and Conventional Loans

FHA, VA, and USDA loans are the three government-backed mortgage loans. Conventional loans are not government-backed loans but need to conform to Fannie Mae and Freddie Mac agency guidelines. Government-backed loans are insured by these three government agencies in the event homeowners default on government-backed mortgages.

Government and conventional loans have mandatory waiting period from two years to seven years after the recorded date of the housing event or a short sale. Non-QM loans one day out of foreclosure does not have any waiting period requirements after a housing event.

How Soon After Foreclosure Can You Get a Home Mortgage Loan?

The good news is that there are loans that are readily available for you when this happens. The better news is that these loans don’t have strict requirements if you are such a borrower, as you can qualify even a day after the foreclosure is dropped. So, which loans are we talking about here? Non-QMs, of course! We will tell more about getting approved for a mortgage loan with non-QM loans one day out of foreclosure with no waiting period requirements. In this article, we will cover the lending requirements for non-QM loans one day out of foreclosure. Read on.

How Does a Foreclosure Affect Your Credit?

Many lenders view foreclosure as a serious derogatory event on a borrower’s credit report, meaning that any borrower who has gone through it may have a pretty difficult time when trying to secure another mortgage. Now, lenders won’t start the foreclosure process unless you have missed over four consecutive mortgage payments. And when you miss this many payments, your credit score is significantly reduced, even by over 100 points, and don’t forget that’s before the foreclosure itself.

Things could get worse if you are also behind in other payments, as the credit score will drop even further. A legitimate foreclosure will remain on your credit report for seven years, and any attempt to have it removed before then is usually fruitless. However, the impact of the foreclosure usually lessens over time – all you need is to keep up with your bills.

Waiting Period Guidelines on Conventional Loans

When it comes to conventional/qualified mortgage lenders, they all impose a waiting-period requirement for all borrowers who have undergone foreclosure before. This basically means that you are restricted or can’t qualify for these mortgages for a specified time –which may vary depending on the lender and the type of loan you go for.

Fannie Mae and Freddie Mac Guidelines on Conventional Loans After Foreclosure

For instance, for traditional mortgages that follow the Fannie Mae and Freddie Mac rules, you are required to wait through the seven-year period after the foreclosure before you can be considered for the loan. However, should you be able to prove extenuating circumstances to be the main reason for the foreclosure, then the waiting period may be reduced to three years. These are events that occurred and were out of your control and significantly reduced your income while increasing your expenses.

HUD Guidelines on Waiting Period After Foreclosure on FHA Loans

Then there is another type of mortgage referred to as the FHA loan, which the Federal Housing Administration backs. For these mortgages, you will have to wait for three years after the foreclosure, deed in lieu of foreclosure, or short sale before you are eligible to qualify. The waiting period start date is from the recorded date of the foreclosure or deed in lieu of foreclosure.

HUD Guidelines on FHA Loans After Short Sale

With short sales, the waiting period start date is from the short sale closing date reflected on the closing disclosure. Again, this period may be reduced if you can prove extenuating circumstances. The third type of mortgages are VA loans, which are backed by the Department of Veterans Affairs. So, for these ones, a borrower is required to wait for two years before being considered. But if you can prove financial hardship, you might be able to get one sooner.

What About Non-QM Mortgages?

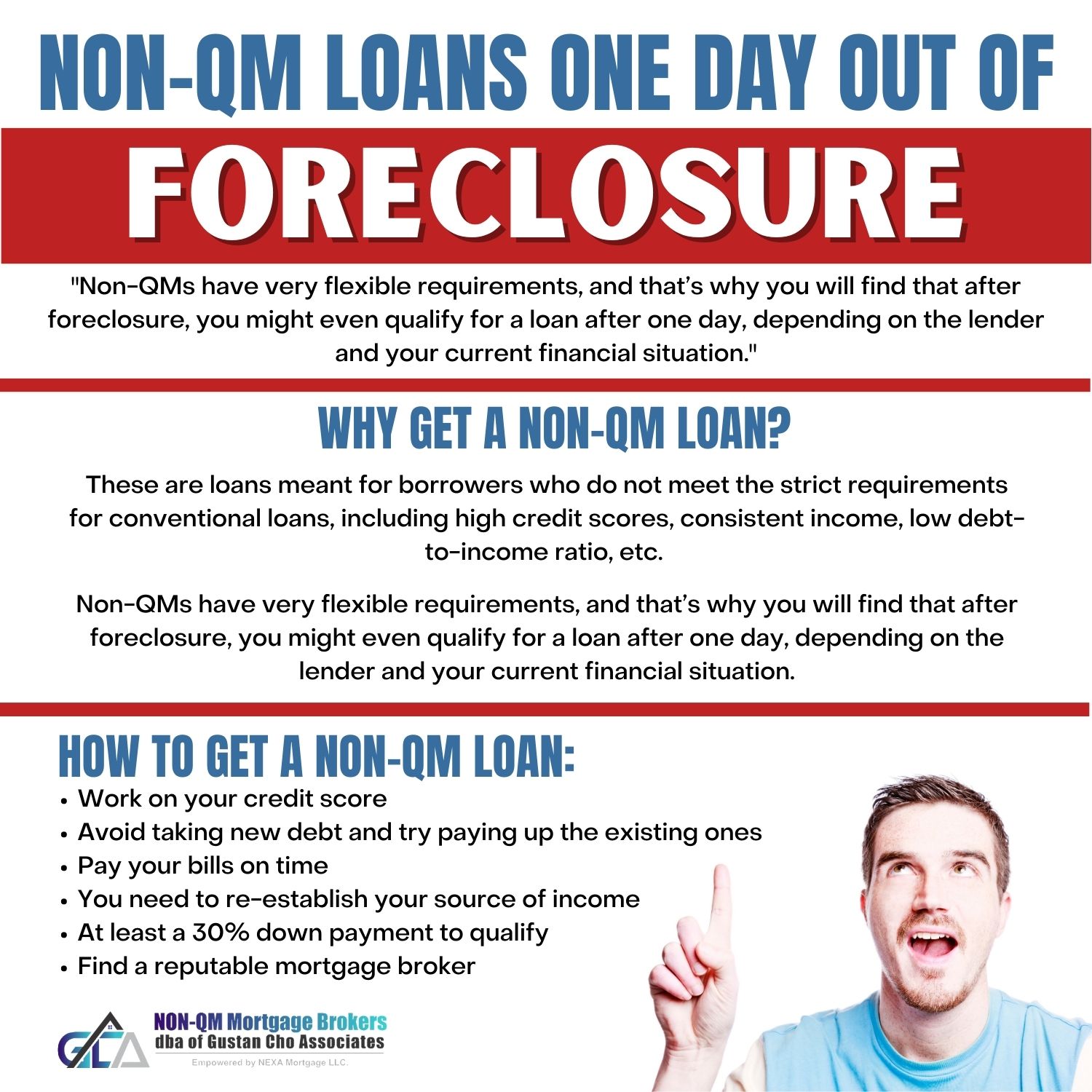

When it comes to Non-QM mortgages, things now change! For starters, these are loans meant for borrowers who do not meet the strict requirements for conventional loans, including high credit scores, consistent income, low debt-to-income ratio, etc. Non-QMs have very flexible requirements, and that’s why you will find that after foreclosure, you might even qualify for a loan after one day, depending on the lender and your current financial situation.

How Is The Non-QM Mortgage Loan Process?

With non-QM mortgage loans, the lender is not much interested in your financial history, as he/she is interested in your current situation, plus your ability to pay for the loan given your financial status. You will also need at least a 30% down payment for you to qualify – this percentage is calculated against the value of the property or the amount of funds you seek through the mortgage. You also have to note that these loans attract higher interest rates compared to conventional ones.

How to get a Non-QM Loans One Day Out of Foreclosure

Now that you know you can qualify for a loan even after a day of foreclosure being dropped, let’s take a look at how you can go about it, shall we?

Now that you know you can qualify for a loan even after a day of foreclosure being dropped, let’s take a look at how you can go about it, shall we?

Work on your credit score:

There is the thing, while we usually say that Non-QM loan requirements are pretty relaxed, there are thresholds or limits below which you can’t go beyond. So, when it comes to the credit score, you are at least required to have a credit score of 500 FICO. This means that if you have gone below this level after the foreclosure, you will definitely need to work to improve it. As we mentioned above, a foreclosure may reduce your score by over 100 points, which can easily take you below the 500 mark. With that said, here is what you can do to get your credit score ready for a Non-QM mortgage:

Avoid taking new debt and try paying up the existing ones:

Taking additional debt could do you more harm than good when applying for a Non-QM loan. This is because additional loans will increase your debt-to-income ratio to unsustainable levels, to the point where the lender considers you an extreme risk. Remember, the lender wants to be convinced that you can make the monthly loan payments without fail. With a high DTI, this seems quite unlikely. Also, if you have existing debts, try paying them as well, so as to bring down the DTI ratio to at least 43%, which is the level accepted by Non-QM lenders. You may also want to avoid large purchases or anything that will make you withdraw too much money from your account. Remember, you need to have as much saved up as possible.

Pay your bills on time:

If there is one thing that greatly boosts your FICO score, it is paying your bills on time. One late payment in the months or weeks preceding the loan application date might make the lender doubt your suitability for the mortgage. So, do everything possible to ensure you don’t miss any payment.

Likelihood For Employment and Income To Continue

You may also need to re-establish your income – after a foreclosure, you need to re-establish your source of income:

If it’s a business or any other independent work. Basically, the lender wants to see that, indeed, they are funds flowing in your account. This gives the lender confidence that you can pay up the loan should you get it. And when you do so, it is important that you maintain good records to prove it to the lender. The ability to repay a mortgage is one of the most important factors mortgage underwriters look at.

Down Payment Requirements For Non-QM Loans One Day Out of Foreclosure

Save as much as you can – this is very important when you want to qualify for a Non-QM mortgage.

As we’ve already mentioned, you need at least a 30% down payment to qualify, which means that you have to save over 30 percent of the money you need for the mortgage. The presence of these funds in your account demonstrates to the lender that you will be able to repay the loan, even in case of emergencies. Basically, these funds are meant to cover at least 12 months or so of the loan payments after you get it. So, if you have to cut back on major expenses to save, you have to do it. Take a look at your life and spending habits pre-foreclosure, try to uncover where you could have gone wrong in your spending, and try to improve. In the end, it will all be worth it.

How To Find The Best Non-QM Mortgage Broker For Non-QM Loans One Day Out of Foreclosure

Find a reputable mortgage broker – this also is a very important step!

There are many Non-QM lenders out there, but finding one who will understand your situation fully and give you a loan product that fits what you need at favorable terms is not that easy. So, take your time, do your research, read reviews and make sure you get a mortgage broker with a lot of knowledge and experience in the field.

How To Qualify For Non-QM Loans One Day Out of Foreclosure

The key to qualifying for non-QM loans one day out of foreclosure is the down payment. Non-QM mortgage rates are slightly higher than traditional mortgage rates on conforming loans. However, the down payment is often the biggest hurdle homebuyers for non-QM loans one day out of foreclosure face.

The down payment requirements on non-QM loans one day out of foreclosure is between a 10% to a 30% down payment. The longer the housing event has been seasoned, the smaller the down payment requirement. The higher the borrower’s credit scores, the lower the down payment requirements.

Mortgage Rates on Non-QM Loans One Day Out of Foreclosure

Mortgage rates on non-QM loans one day out of foreclosure depends on the borrower’s longevity out of foreclosure, the down payment, and the borrower’s credit scores. The less risk non-QM mortgage brokers have on non-QM loans one day out of foreclosure, the lower the down payment requirements and the lower the mortgage rates.

The Benefits of Non-QM Loans One Day Out of Foreclosure

The benefits of non-QM loans one day out of foreclosure enables homebuyers who have recovered sooner than most after a housing event to be able to qualify for a mortgage. Many homebuyers recover sooner than others after a bankruptcy or a foreclosure. Some people recover and rebuild their credit months after a housing event. A housing event is a foreclosure, a deed in lieu of foreclosure, or short sale. The team at Non-QM Mortgage Brokers have helped thousands to rebuild their credit and boost their credit scores to over 700 FICO in less than one year.

How To Get Pre-Approved For Non-QM Loans One Day Out of Foreclosure

At some part of our lives, we may end up in financial hardship, to the point that we default on loans and previous mortgages, resulting in foreclosure. And to be fair, any person can get here! Yet the fact of the matter is, if you have been here, it does not mean that you can never recover. On the contrary, this can, in turn, become a motivator or a wake-up call that something in your life needs to change – especially your spending habits.

That said, it is essential for individuals who have gone through foreclosure to understand that there are still non-QM loan options available to them. While these loans can be more expensive than traditional ones, they provide access to financing for those who might not otherwise qualify. To ensure that you get the best deal possible, it is important to shop around and compare rates from different lenders. Additionally, it is also wise to work with a financial advisor that understands both traditional mortgages and non-QM loans in order to maximize your options.