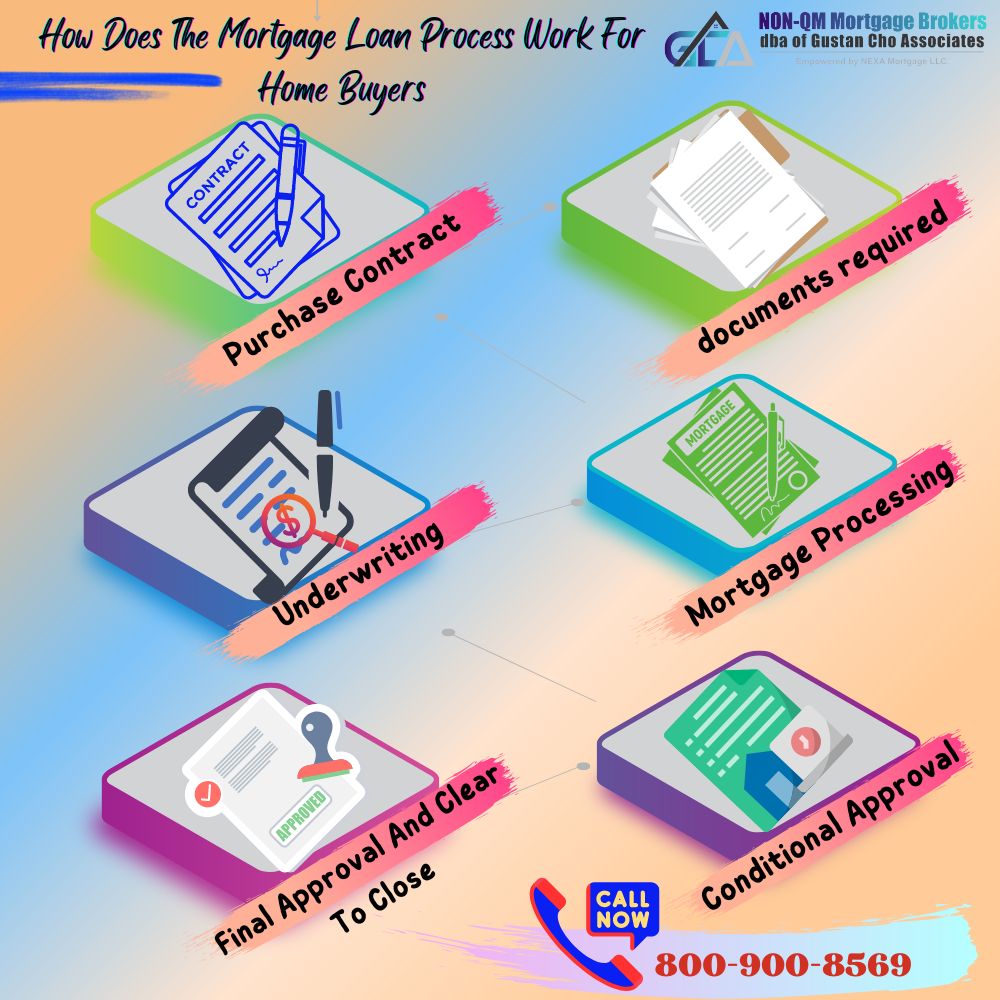

How Does The Mortgage Process Work

In this guide, we will cover how the mortgage process work. The mortgage process is similar whether borrowers apply for a home purchase or refinance a loan. There are a series of stages the file needs to go through. Most mortgage applications take 30 days to close from the time the loan originator prepares and has borrowers sign and acknowledge disclosures. The mortgage process leads to a clear to close, and closing starts when the borrower receives the loan estimate.

Documents Required During The Mortgage Process

One of the biggest reasons for delays during the mortgage process is due to the file being submitted with incomplete, illegible, or missing documents required during the mortgage process. Borrowers, such as the following require documents:

- two years’ tax returns

- two years W-2s, two months bank statements

- 30 days paycheck stubs

- 60 days bank statements

- other items that may apply to the particular mortgage loan applicant

- divorce papers

- bankruptcy paperwork

- foreclosure paperwork

- child support paperwork, etc.

There is a difference between a good processor and a great mortgage processor. A great mortgage processor will not submit a file to underwriting unless the documents required are complete, legible, and there are no missing pages. It is better to wait and submit the entire paperwork when it is complete instead of piecemeal. Any delays in getting these documents will cause a delay in the mortgage loan process and could potentially delay the home closing.

Pre-Approval Step During The Mortgage Process

Borrowers intending to purchase or refinance their current home need to contact a lender to qualify and get pre-approved. The first step in the mortgage process is to consult with a loan officer. The loan originator will require the borrower to complete a four-page application, commonly called 1003, and will run credit.

The loan officer will then ask to provide preliminary documents to verify income to calculate debt to income ratios. Credit, income, and debt to income ratios will be the determinant that dictates qualification.

Once the loan originator reviews the loan application, credit report, and preliminary documents, the file will be submitted to Fannie Mae’s Automated Underwriting System. Within minutes, the Automated Underwriting System will render automated findings.

What Is The Automated Underwriting System

If everything goes well, borrowers will get an approve eligible per DU FINDINGS and should be set to go. I normally go off DU FINDINGS since I have no mortgage lender overlays.

With approve/eligible per DU FINDINGS, we can close on borrowers loan as long as borrower can satisfy conditions on AUS. There are lenders, especially banks and credit unions, that have stricter lending requirements called lender overlays.

Many lenders have their overlays where they impose higher lending requirements than what is required by the Automated Underwriting System. Once the borrower gets an automated approval per DU FINDINGS, borrowers will be issued a pre-approval letter and can shop for a home.

Real Estate Purchase Contract

Armed with a pre-approval letter, homebuyers should now be able to shop for a home. Most sellers’ agents will not show potential buyers a home without a pre-approval letter. Some sellers’ agents may request that they speak with a loan officer directly.

Once home buyer decides on making an offer on the home of their liking, they can submit an earnest money check along with the offer. The real estate purchase contract needs to be accepted and signed by the seller to accept or come back with a counteroffer.

Once the buyer and seller agree on mutual acceptance, the home buyer submits the real estate contract to a loan officer. The loan officer cannot start the mortgage loan process until he or she has a signed real estate contract. Once the loan officer gets the signed real estate contract, the mortgage loan process begins.

Mortgage Processing

Once a loan officer gets the signed purchase contract, the mortgage file will be assigned to a mortgage processor. The processor, besides the underwriter, is the most important person in the mortgage loan process. It is the processor that is the auditor that reviews borrowers’ files.

The processor makes sure the mortgage package is complete. It is the processor to make sure that borrowers have no overdrafts in past 60 days bank statements. The mortgage processor reviews there are no irregular deposits on bank statements.

If there is, the processor will request a letter of explanation for sourcing the irregular deposit. If the mortgage package information is missing pertinent information or incomplete and gets submitted to underwriting, the closing may delay. A mortgage processor’s main goal is to get as few conditions back from the underwriter. A great processor submitting a complete package can get conditional approval with very few to no conditions.

The Role of The Mortgage Processor

An incompetent or rookie processor can get back 30-plus conditions, if not more. The processor will work very closely with the mortgage originator and underwriter. It is the processor’s job to do the following:

- order appraisal

- order title insurance

- verification of employment

- verification of rent

- verification of mortgage

- verification of deposit

- make sure everyone from the title company to the buyer’s and seller’s attorneys are kept in the loop

- If the mortgage application is a refinance loan, the processor orders the payoff

The processor will also work with the homeowner’s insurance carrier to ensure that the subject property has proper insurance and get the invoice for the homeowner’s insurance so it can be paid at closing.

Underwriting In The Mortgage Process

Once the mortgage processor has processed the loan application, it gets submitted to the underwriting department and assigned to a mortgage underwriter. The mortgage underwriter is the most important person in the mortgage loan process.

The underwriter is the person who will determine whether the mortgage application gets approved or denied and issues the clear to close. The CTC, CLEAR TO CLOSE, is issued by the underwriter.

CTC means the lender is ready to prep closing docs and fund the mortgage loan. The mortgage underwriter will review the mortgage loan application, credit report, credit scores, and all the documents provided by the processor. If the underwriter sees that everything is in compliance and the file meets all the lending guidelines, the underwriter will issue a conditional approval.

What Is The Conditional Approval?

Conditional approval is a mortgage loan approval issued by the underwriter with a list of conditions that the underwriter is requesting. Conditions can be items that the processor, such as the following, overlooked:

- recent paycheck stub

- irregular deposit

- , or it can be that the underwriter does not yet have the appraisal back

Once all of the conditions from the mortgage underwriter have been met, the underwriter will sign off on it and issue a clear to close.

Final Approval and Clear To Close

After the processor has accumulated all of the conditions, the processor then submits all the conditions requested by the mortgage underwriter for review.

Two things can happen during this stage of the mortgage loan process. The mortgage underwriter can sign off on the conditions and issue a clear to close. Or the mortgage underwriter can find additional conditions from the items provided.

Updated conditional loan approval is re-issued if the mortgage underwriter needs additional conditions. The processor must repeat this step until the underwriter signs off and issues a final approval and a clear to close. The Closing Disclosure (CD) is currently prepared for buyers and sellers.

Mortgage Lenders Docs Sent To Title Company

Once borrowers get final approval and clear to close and the CD has been approved, the lender prepares mortgage documents and emails it to the title company. Once the borrower signs the mortgage docs and all parties sign CD, the wire is sent to the title company, and funds are disbursed. The buyer gets keys and home ownership, and the seller gets the sale proceeds.d

Related> 5 things you need to be pre-approved for a mortgage