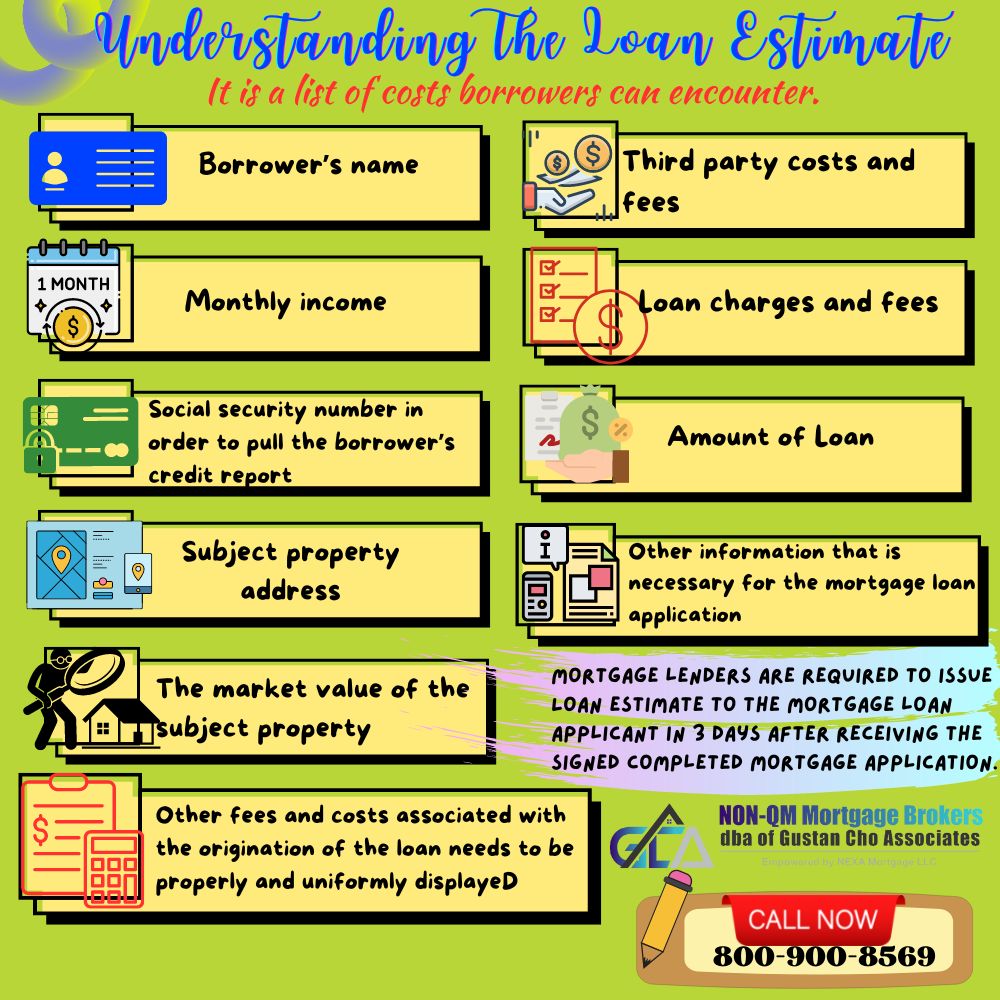

Understanding The Loan Estimate

This blog will cover understanding the loan estimate during the mortgage loan process. The main purpose for the CFPB to launch the loan estimate is to encourage home buyers to compare and shop for costs and fees from other mortgage lenders before deciding which lender to go with. The purpose of the Loan Estimate is to help borrowers comprehend and fully understand the services they can shop for, not only for the best terms and the lowest available mortgage rates but also for the best third-party charges.

Why Was The GFE Replaced With The LE

The residential mortgage industry is extremely regulated, unlike the commercial mortgage industry. The Old Good Faith Estimate was multiple pages and hard to understand. Understand The Loan Estimate is very important and is the sole reason regulators replaced the old GFE with the new LE. Dale Elenteny of Gustan Cho Associates explains the loan estimate:

The government wants to make sure that consumers who shop for residential mortgage loans are protected. The mortgage industry underwent a major overhaul after the 2008 real estate and mortgage meltdown. This included the elimination of no doc and stated income mortgage loans. Thousands of mortgage companies went out of business.

The whole subprime mortgage industry got wiped out. Disclosures and over-disclosures with mortgage applications became the norm. The Good Faith Estimate was implemented. The purpose of helping mortgage loan applicants from excessive charges. The GFE was eventually replaced with the LE.

What Is The Definition Of Good Faith Estimate And Loan Estimate

- borrower’s name

- monthly income

- social security number in order to pull the borrower’s credit report

- subject property address

- the market value of the subject property

- amount of loan

- other information that is necessary for the mortgage loan application

- loan charges and fees

- third party costs and fees

- other fees and costs associated with the origination of the loan needs to be properly and uniformly displayed

Shopping For Home Loan And Understanding The Loan Estimate

How Accurate Are The Fees And Costs Listed On The Loan Estimate

The Loan Estimate is just what it states. It is a list of costs borrowers can encounter. If they do not use a particular vendor or is not required that the fees and/or costs does not apply to them. Many borrowers do not believe in the Loan Estimate and think it is just worthless. A mortgage loan originator needs to prepare the Loan Estimate. The Loan Estimate has many costs and fees that a mortgage loan originator needs to list where the mortgage loan originator may be clueless and just overly disclose.

The Third-Party Fees Listed On The Loan Estimate

Third-party fees and costs that a mortgage loan originator needs to list on the LE, the loan officer may not know. If the home has a septic/well system, the loan officer needs to disclose how much a septic and well inspection costs. The loan officer still needs to list it on the Loan Estimate in the event if the home buyer does encounter a well on the property and wants it inspected. Even though the loan officer has absolutely nothing to do with the third party well and septic inspection, the loan officer is liable for the cost of the well and septic inspection if he or she did not list it on the Loan Estimate. How does the loan officer know the cost of a well and septic inspection? Most mortgage loan originators will probably list $1,000 on a well and septic inspection. Even though a well and septic inspection may only cost $200.00, if the mortgage loan originator under discloses it the loan officer can be held liable.

If the well and septic inspection goes over what the loan officer listed as an estimate, the loan officer is liable for anything that is over 10% of the original estimate he or she listed. However, if the loan officer over discloses it like stating it as $1,000, anything costs and fees under $1,000, the loan officer is not liable for. That is why the Loan Estimate is not an accurate indicator of the costs and fees involved with the purchase of a home and origination of a mortgage loan.