Timeshare Foreclosure Waiting Period Mortgage Guidelines

This blog will discuss the waiting period requirements after a timeshare foreclosure. One of the most frequently asked questions at Non-QM Mortgage Brokers is whether I qualify for a mortgage after a timeshare foreclosure. Dale Elenteny of Non-QM Mortgage Brokers said the following about timeshare foreclosure:

Many homebuyers go to lenders to get qualified for a home mortgage with a timeshare foreclosure and are told they cannot qualify for a mortgage with a timeshare foreclosure.

Homebuyers must wait three years after a timeshare foreclosure on FHA loans, two years after a VA loan, and seven years after a timeshare foreclosure on conventional loans. This is not true. There is no waiting period after timeshare foreclosure to qualify for an FHA, VA, USDA, or conventional loan.

Does a Timeshare Count as a Mortgage?

Is a timeshare foreclosure considered a mortgage foreclosure or an installment loan default? The answer to the frequently asked question of doing a timeshare foreclosure counts as a mortgage is an absolute NO.

A timeshare is not a real estate loan. A timeshare is considered an installment loan. All agency mortgage guidelines count a timesahare foreclosure as an installment loan foreclosure and not a real estate foreclosure.

Agency mortgage guidelines on installment loan default apply and are not a real estate foreclosure. Therefore, homebuyers have no waiting period after a timeshare foreclosure. I get this question asked several times a week.

Do Lenders Have Different Requirements for Timeshare Foreclosure?

Not all lenders have the same timeshare foreclosure requirements. Even though a timeshare is not considered a real estate property, many lenders still consider a timeshare foreclosure as a real estate foreclosure and mandate a waiting period requirement. John Strange of Non-QM Mortgage Brokers made the following statement about agency guidelines versus lender overlays:

If you get denied for a mortgage after a timeshare foreclosure, go to a mortgage lender with no lender overlays timeshare foreclosure.

Many home buyers contact us and ask Is A Timeshare Foreclosure Considered Mortgage Foreclosure Or Installment Loan? FHA loans are the easiest loan program to get an approve/eligible per the automated underwriting system with a recent timeshare foreclosure. Many folks checked HUD Guidelines on waiting periods after a timeshare foreclosure.

Can You Buy a House After a Timeshare Foreclosure?

It states that a timeshare foreclosure is an installment loan, not real estate. Many folks get told by loan officers and many times by mortgage underwriters that timeshare foreclosure is the same as a real estate foreclosure.

No waiting period is required after a timeshare foreclosure to qualify for a home mortgage.

Non-QM Mortgage Brokers have helped countless homebuyers after a timeshare foreclosure with no mandatory waiting period requirements.

Is Timeshare Considered a Real Estate or an Installment Loan?

Under HUD guidelines, a loan collateralized by an interest in a timeshare is not considered a housing obligation. Under HUD Agency Mortgage Guidelines, a timeshare is not considered real estate.

A timeshare is considered an installment loan. Therefore, since it is not considered real estate, a timeshare foreclosure is a defaulted installment loan.

Under HUD Guidelines on timeshare foreclosure states, there is no waiting period because timeshare loans are considered installment loans and not a mortgage.

Waiting Period After Timeshare Foreclosure Versus Real Estate Foreclosure

Timeshare loans are loans secured by an interest in a timeshare, which is considered an installment loan.

There is no waiting period after a timeshare foreclosure on government and conventional loans since timeshares are NOT real estate loans. This holds true even though the timeshare property results in a timeshare foreclosure.

Therefore, borrowers with a foreclosure on a timeshare resulting in foreclosure have no waiting period to qualify for FHA, VA, USDA, and conventional loans after the timeshare foreclosure. They can qualify for government or conventional loans regardless of when the timeshare payments went into default.

Waiting Period After Foreclosure Versus Timeshare Foreclosure

There are waiting period requirements after a housing event. A housing event is a foreclosure, deed-in-lieu of foreclosure, and short sale. A foreclosure is when a homeowner defaults on a real estate property.

A real estate property is an owner-occupant home, second home, investment home, and not a timeshare. Mandatory waiting period requirements exist to qualify for government or conventional loans.

There is no waiting period after a timeshare foreclosure because a timeshare is not considered a real estate loan. All government home mortgage programs consider timeshare loans as installment loans.

Mortgage Waiting Period Requirements After Foreclosure

There are mandatory after foreclosure to qualify for the following home mortgage loans:

- FHA loans

- VA loans

- USDA loans

- Fannie Mae and Freddie Mac which are Conventional loans

- Jumbo mortgages

NON-QM Loans have no waiting period requirements after housing events and bankruptcy. Non-QM Mortgage Brokers offer home mortgages one day out of foreclosure or bankruptcy with non-QM loans.

Mortgage Waiting Period After Foreclosure Requirements

The following home mortgage loan programs have mandatory waiting periods after foreclosure. HUD requires a waiting period of 3 years after a foreclosure and deed-in-lieu of foreclosure from the recorded date to qualify for an FHA loan. VA loans have a two-year waiting period after the recorded date of the deed-in-lieu of foreclosure or foreclosure to qualify. USDA has a three-year waiting period to qualify for a USDA Loan after the recorded date of the foreclosure or recorded date of the foreclosure

Fannie Mae and Freddie Mac require a four-year waiting period requirement after a deed-in-lieu of foreclosure or a short sale. Fannie Mae and Mac have a 7-year waiting period after a standard foreclosure to qualify for a Conventional loan after the recorded date.

However, if the borrower has a deed-in-lieu of foreclosure or short sale, the waiting period differs from a regular foreclosure on conventional loans. After a deed-in-lieu of foreclosure or a short sale, the waiting period is greatly reduced to a four-year waiting period to qualify for Conventional loans.

Waiting Period After Foreclosure on Conventional Loans

The waiting period starts clock to qualify for a Conventional Loan starts from the recorded date of the deed-in-lieu of foreclosure reflected on the public records. Or, if it is a short sale, the actual date of the short sale is reflected on the HUD-1 Settlement Statement. Jumbo Mortgages are considered non-conforming loans. They do not conform to Fannie Mae or Freddie Mac Conforming Guidelines.

Jumbo Loans After Foreclosure Mortgage Guidelines

Any home mortgage loans that exceed the maximum Fannie Mae or Freddie Mac conforming limit of $726,200 are considered jumbo loans.

Most lenders will set their waiting period requirements after foreclosure to qualify for Jumbo loans. Most lenders will require a 7-year waiting period to qualify for a Jumbo Mortgage after foreclosure.

Non-QM Mortgage Brokers have Non-QM Jumbo Mortgages with no waiting period after foreclosure, deed-in-lieu of foreclosure, short sale, or bankruptcy.

Why Am I Told That Timeshare Foreclosure Is a Foreclosure?

A timeshare is considered an installment loan and not real estate. If a timeshare owner forecloses on a timeshare, they are treated like they have defaulted on an installment loan.

The defaulted timeshare loan will be treated like a defaulted installment loan. Mortgage borrowers can qualify for any other government or conventional loan with a defaulted installment loan. The defaulted installment loan must not be repaid and qualifies for a home mortgage.

Most lenders normally treat a timeshare foreclosure like a charged-off account with no lender overlays.

HUD Guidelines on FHA Loan After Timeshare Foreclosure

Just because you may meet HUD Guidelines on Qualifying For A FHA loan after timeshare foreclosure, the lender you consulted with may have their overlays. They may have Lending Requirements that are above and beyond those of the minimum FHA Guidelines.

Lenders overlays are additional lending requirements imposed by lenders that are above and beyond the minimum HUD Agency Guidelines.

Lender overlays are perfectly legal, and most lenders do have overlays. Non-QM Mortgage Brokers has zero lender overlays on government and conventional loans. Non-QM Mortgage Brokers does do not have any waiting period requirements after timeshare foreclosure.

What Are Lender Overlays?

Lender overlays are mortgage lending requirements that are above and beyond the minimum mortgage guidelines set by :

- FHA

- VA

- USDA

- FANNIE MAE

- FREDDIE MAC

Non-QM Mortgage Brokers is a national mortgage company licensed in multiple states with no lender overlays on government and conventional loans.

Examples of Lender Overlays on Home Loans

Let’s take case scenarios of typical overlays on FHA loans to explain better what overlays are. We will use FHA loans in this case study since

FHA loans are the most popular loan programs for first-time homebuyers, borrowers with bad credit and low credit scores, and homebuyers with recent timeshare foreclosure. Lender overlays apply to all government and conventional loans.

We will go over case scenarios of lender overlays on FHA credit scores. Most lenders will have FHA Guidelines on credit scores. HUD requires to qualify for a 3.5% down payment FHA loan. The borrower needs a minimum of 580 FICO. However, most lenders will require a minimum of a 620 FICO credit score, while most banks will require a 640 FICO Credit Score.

Not All Lenders Have The Same Lending Requirements

HUD allows borrowers under 580 credit scores and a 500 FICO to qualify for an FHA loan. However, borrowers under 580 credit scores require a 10% versus a 3.5% down payment.

Although HUD, the parent of FHA, requires only a 580 credit score on a 3.5% down payment FHA loan, lenders can require a higher score due to their overlays. Overlays on credit scores are a higher credit score requirement to qualify for an FHA loan.

Overlays are when borrowers qualify for an FHA loan but do not qualify with the particular lender they consulted. Non-QM Mortgage Brokers have no overlays on government and conventional loans.

HUD Guidelines on Collection Accounts

Most lenders will have overlays on collection accounts. They will require borrowers to pay off outstanding collection accounts to qualify.

Under HUD guidelines on collection accounts, outstanding collection and charged-off accounts do not have to be paid. HUD collection guidelines state that borrowers must not pay off outstanding collections to qualify for FHA loans. However, most lenders will have overlays on collection accounts with outstanding balances.

They will require borrowers to pay off all their outstanding collections with balances or may have a maximum limit on outstanding balances on unpaid collection accounts. Non-QM Mortgage Brokers do not have any overlays on outstanding collection accounts. This holds true no matter how much the unpaid outstanding balances on their collections are.

HUD Guidelines Versus Overlays On Charged-Off Accounts

HUD guidelines on charge-off accounts. Most lenders have lender overlays on charge-off accounts. They will require Borrowers to pay off outstanding charge-off accounts to qualify for FHA loans.

HUD charge-off guidelines do not require borrowers to qualify to pay off outstanding charge-off accounts. Borrowers can qualify for an FHA loan with an outstanding charge-off account no matter how much the outstanding charge-off account balance is.

Non-QM Mortgage Brokers do not have any overlays on charge-offs. This holds true no matter how large the outstanding charge-off account balance is.

HUD Guidelines on Debt-To-Income Ratio

In this section, we will cover HUD guidelines on the debt-to-income ratio. Most lenders will have overlays on debt to income ratio. They will limit the maximum debt to income to 45% DTI to 50% DTI due to their overlays.

HUD allows the maximum allowable debt-to-income ratio is 56.9% DTI to get an approve/eligible per AUS. Non-QM Mortgage Brokers has no overlays on debt-to-income ratios

The maximum debt-to-income ratio allowed to get an approve/eligible per automated underwriting system on FHA loans is a 46.9% front end and 56.9% DTI back end debt-to-income ratio.

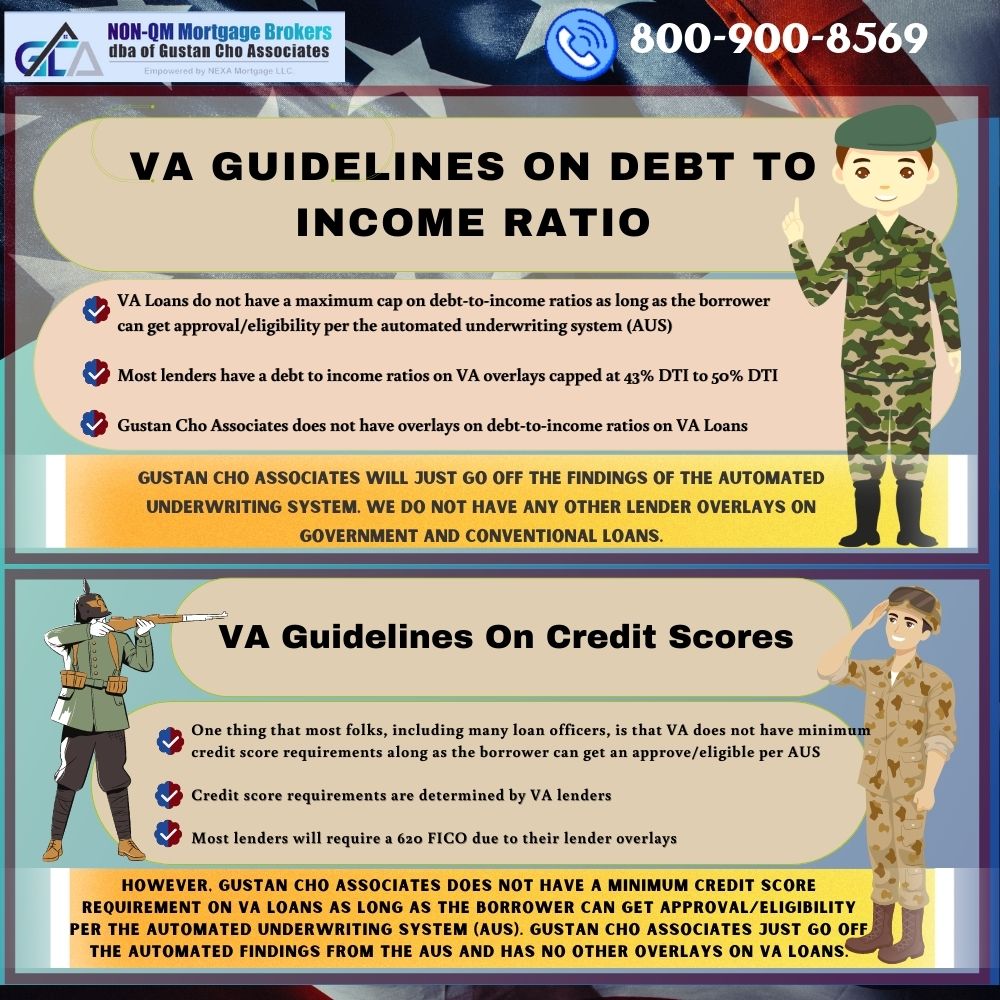

VA Guidelines on Debt-To-Income Ratio

In this section, we will cover VA guidelines on the debt-to-income ratio. VA loans do not have a maximum cap on debt-to-income ratios as long as the borrower can get an approve/eligible per the automated underwriting system (AUS).

Most lenders have a debt to income ratios on VA overlays capped at 43% DTI to 50% DTI. Non-QM Mortgage Brokers does not have overlays on debt-to-income ratios on VA loans.

Non-QM Mortgage Brokers will go off the findings of the Automated Underwriting System. We do not have any other lender overlays on government and conventional loans.

VA Loans For Bad Credit With Low Credit Scores

There is no mandatory waiting period after timeshare foreclosure on VA loans. There is no minimum credit score requirements on VA loans.

VA Guidelines on Credit Scores

One thing that most folks, including many loan officers, is that VA does not have minimum credit score requirements, along the borrower can get approve/eligible per AUS. VA lenders determine credit score requirements. Most lenders will require a 620 FICO due to their lender overlays.

Non-QM Mortgage Brokers do not have a minimum credit score requirement on VA loans as long as the borrower can get approve/eligible per the automated underwriting system (AUS).

Non-QM Mortgage Brokers go off the automated findings from the AUS and have no other overlays on VA loans.

Qualifying For Mortgage With Timeshare Foreclosure

The above bullet points are examples of overlays set by lenders, which apply to qualifying for government and conventional loans after a timeshare foreclosure. Again, FHA, VA, USDA, Fannie Mae, and Freddie Mac consider a timeshare secured by a loan an installment loan, not a real estate loan.

There is no waiting period after a timeshare foreclosure to qualify for government and conventional loans. If told buyers do not qualify for government or conforming loans due to timeshare foreclosure, call us at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.

Non-QM Mortgage Brokers is a five-start national lender licensed in multiple states with no lender overlays on FHA, VA, USDA, and Conventional loans. We have a solid 5-star national reputation for its no overlays and ability to close loans in 21 days or less. The Non-QM Mortgage Brokers team is available seven days a week, evenings, weekends, and holidays.