Mortgage After a Deed-In-Lieu Versus Foreclosure

This guide will cover qualifying for a mortgage after deed-in-lieu versus foreclosure. Government loans treat a short sale and deed-in-lieu versus foreclosure differently concerning the mandatory waiting period to qualify for a mortgage. There is a mandatory waiting period after housing events with government and conventional loans. A housing event is the following:

- Foreclosure

- Deed-in-lieu of foreclosure

- Short sale

In this article, we will discuss and cover qualifying for a mortgage after deed-in-lieu of foreclosure versus foreclosure on conventional loans.

What Is a Deed-In-Lieu of Foreclosure Versus Foreclosure

A deed-in-lieu of foreclosure is when a homeowner who can no longer afford their home agrees with their lender to voluntarily surrender the deed to their home in place of foreclosure. John Strange of Non-QM Mortgage Brokers said the following about a deed-in-lieu of foreclosure versus foreclosure:

Most lenders will help to work with homeowners who have trouble making their mortgage payments instead of foreclosing. Lenders normally work with homeowners by offering them a deed in lieu of foreclosure and/or short sale. Saves time, money, and red tape.

It costs a lot for lenders dealing with attorneys, courts, and sheriff’s departments going through foreclosure. A deed-in-lieu of foreclosure is more beneficial and advantageous to lenders and homeowners. This is because lenders normally agree to forgive the outstanding debt of the mortgage loan.

Main Reasons Why Homeowners Foreclosure on Their Homes

The reason why homeowners foreclose on their homes is that the mortgage is normally more than the value of their home value. There is no equity. Selling it on the marketplace is not an option because the mortgage balance is higher than the home value. Dale Elententy of Non-QM Mortgage Brokers said the following about deed-in-lieu versus foreclosure:

If lenders were to foreclose the likelihood of a deficit is likely. Lenders can go after the homeowner for the deficiency. However, with a deed in lieu of foreclosure, lenders will agree to forgive the homeowner the deficit.

The homeowner surrenders the keys to the home and vacates. The homeowner agrees to surrender the deed to the home, and the lender will not pursue future litigation by suing the homeowner with a potential deficiency judgment.

Mortgage After Deed-In-Lieu Versus Foreclosure

Homeowners with a before a deed-in-lieu versus foreclosure can purchase a home again after waiting for the mandatory waiting period after a deed-in-lieu versus foreclosure. For FHA loans, the mandatory waiting period after a short sale, deed-lieu of foreclosure, or foreclosure is a 3-year wait period.

VA loans require a two-year wait period after the housing event. There is a mandatory waiting period after the recorded date of a deed-in=lieu of foreclosure to qualify for an FHA loan. There is a mandatory waiting period after the recorded date of a standard foreclosure to qualify for an FHA loan. Deed-in-lieu versus foreclosure are treated the same under the eyes of the Federal Housing Administration and have a 3-year wait period.

The minimum credit score required to qualify for FHA loans is 580 after a deed-in-lieu, foreclosure, and short sale. The minimum down payment required is 3.5% on a home purchase as long as the credit scores are at least 580. Borrowers with 500 to 579 credit scores can qualify for FHA loans with a 10% down payment.

How Fannie Mae and Freddie Mac View Deed-in-Lieu Versus Foreclosure

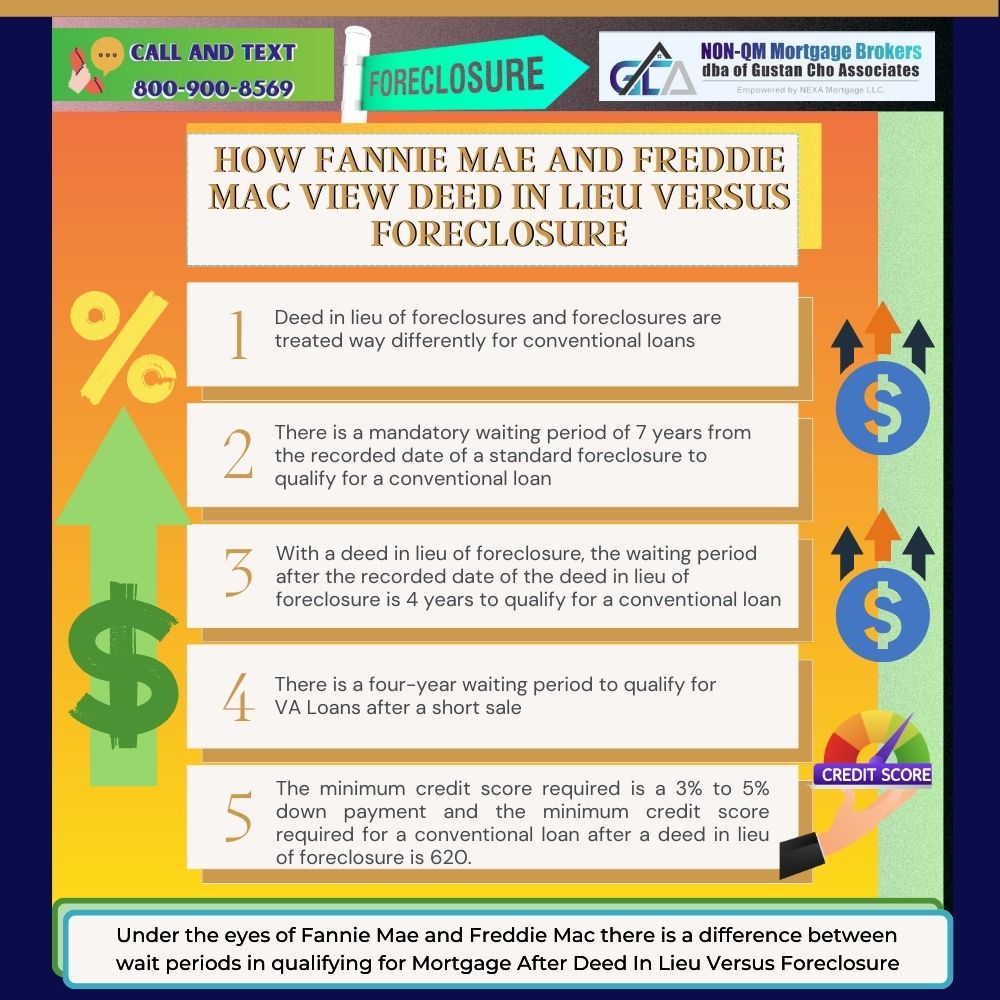

However, under the eyes of Fannie Mae and Freddie Mac, there is a difference between wait periods in qualifying for a mortgage after deed-in-lieu versus foreclosure. Deed-in-lieu versus foreclosure are treated way differently for conventional loans.

There is a mandatory waiting period of 7 years from the recorded date of a standard foreclosure to qualify for a conventional loan.. However, with a deed-in-lieu of foreclosure, the waiting period after the recorded date of the deed-in-lieu versus foreclosure is 4 years to qualify for a conventional loan. There is a four-year waiting period to qualify for VA loans after a short sale.

The minimum credit score required is a 3% down payment, and the minimum credit score required for a conventional loan after a deed-in-lieu and foreclosure is 620.

Non-QM Loans With No Waiting Period After a Housing Event

Non-QM Loans is an alternative portfolio loan program with no waiting period after the housing event. Dale Elenteny of Non-QM Mortgage Brokers said the following about qualifying for non-QM loans with no waiting period after a housing event:

Homebuyers can qualify for a mortgage after deed-in-lieu versus a foreclosure with no waiting period. However, a 10% to 20% down payment is required.

The amount of down payment depends on borrowers’ credit scores. There are no maximum loan limits with non-QM loans. There are no private mortgage insurance requirements with non-QM loans. Non-QM Mortgage Brokers dba of Gustan Cho Associates are mortgage brokers on government and conventional loans and correspondent lenders on non-QM loans.