Mortgage Escrow Guidelines Required By Lenders

This blog will cover mortgage escrow guidelines required by mortgage lenders. In the following sections, we will cover what mortgage escrows are, how escrows work, and what mortgage escrow guidelines are. Ronda Butts of Non-QM Mortgage Brokers explains mortgage escrow guidelines as follows:

Lenders set up escrow accounts to ensure homeowners pay their property taxes and insurance on time. Escrow accounts are mandatory on all government loans. However, escrows are optional on conventional loans if the borrower has less than 80% loan to value.

It is up to the borrower whether or not they want the lender to set up an escrow account. Lenders will collect a proration of the monthly property taxes, homeowners insurance, principal, and interest every month. This article will discuss and cover the escrow guidelines required by mortgage lenders.

Are Escrow Accounts Mandatory By Lenders

Homebuyers who put less than 20% down payment on a home purchase on conventional loans will normally be required to have an escrow from their mortgage lender for property taxes and homeowners’ insurance. Dale Elenteny of Non-QM Mortgage Brokers explains when lenders require escrow accounts:

All government loans require escrows. Those home buyers who put 20% or more in a down payment on a home purchase can waive mortgage escrow. They can pay their property taxes and homeowners insurance when it is due separately.

For those with an escrow, the mortgage lender will review their escrow account once a year to see whether the escrow needs to be increased or decreased to ensure sufficient funds cover any increases in property taxes or homeowners insurance premiums.

Mortgage Escrow For Property Taxes on a Home Purchase

Most states have property taxes re-assessed the year following the home purchase. In this paragraph, we will discuss how escrows work on home mortgages. The property taxes can increase the second year the homeowner owns the home. This can hurt a homeowner who barely qualifies for his or her mortgage loan with high debt-to-income ratios. PITI is fixed for the term of the loan. However, housing payments can increase significantly if property taxes increase.

Any increase in monthly payments can affect their monthly financial budget in cities like Chicago, Illinois. In Chicago, property taxes increased double digits year after year in the mid-1990s and 2000s. Many fixed-income homeowners were forced to sell their homes and relocate due to the high property taxes.

Property taxes normally go up when the value of the property goes up. For homebuyers purchasing a new construction home from a builder, the initial property taxes are assessed on the property taxes of the unimproved lot. The property taxes most likely will go up the second year the homeowner owns their home, which means mortgage escrow will go up significantly to cover the increased property taxes.

Escrow Accounts of Homeowners Insurance Premium

Homeowners’ insurance premiums are also held in a mortgage escrow. Homeowners’ insurance premiums can also increase significantly. David Marden of Non-QM Mortgage Brokers and an insurance agent for Goosehead Insurance said the following about escrowing homeowners insurance premiums.

The mortgage servicer analyzes the annual mortgage insurance premium and will set that budget aside for the upcoming year and readjust the monthly amount they will collect for the borrower’s escrow account.

For example, suppose the homeowner lives in Miami and has hurricane insurance, and several major hurricanes hit the area year after year. In that case, the insurance carrier will likely increase the hurricane insurance premium.

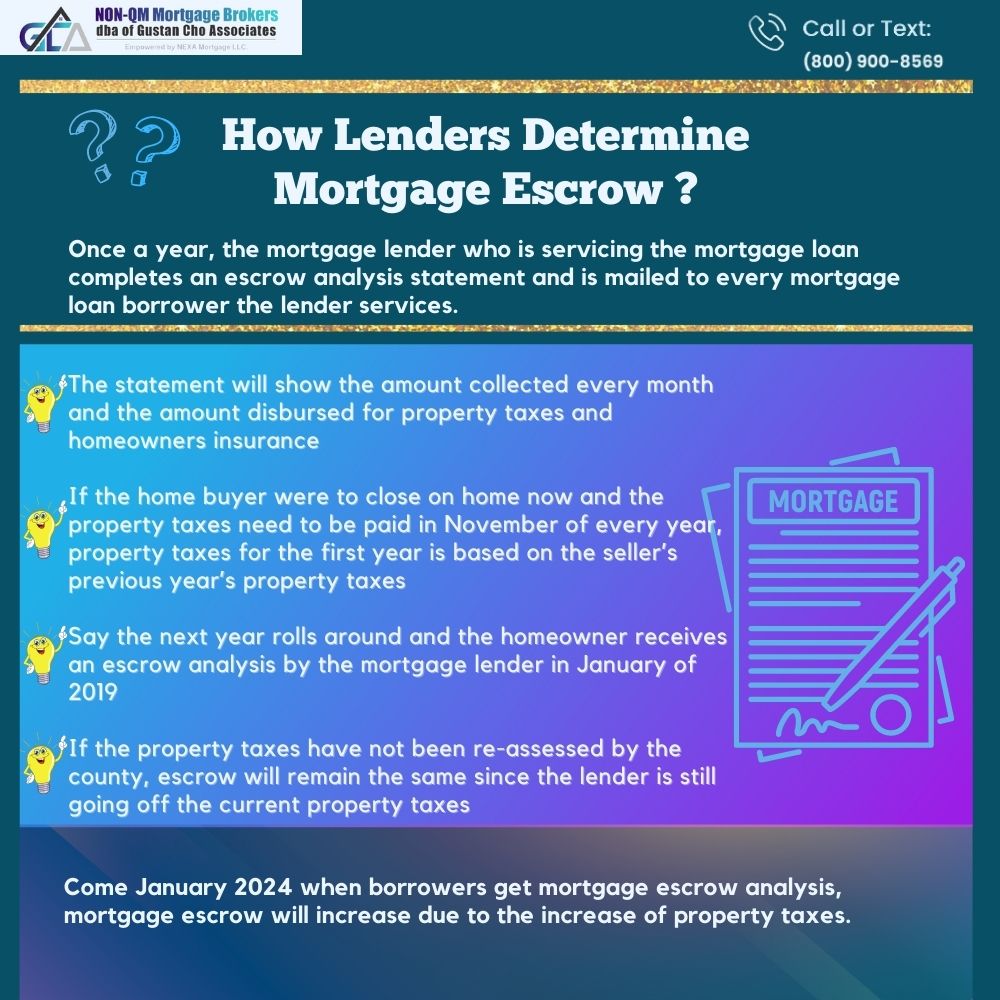

How Lenders Determine Mortgage Escrow

Once a year, the mortgage lender servicing the mortgage loan completes an escrow analysis statement mailed to every mortgage loan borrower the lender services. The statement will show the amount collected monthly and disbursed for property taxes and homeowners insurance. An example of how an escrow account can drastically increase is the following.

If the home buyer were to close on the home now and the property taxes must be paid in November of every year, property taxes for the first year are based on the seller’s previous year’s property taxes. Say the next year rolls around, and the homeowner received an escrow analysis by the mortgage lender in January 2019. If the county has not re-assessed property taxes, escrow will remain the same since the lender is still going off the current property taxes.

Say that lender finds out that property taxes are re-assessed in October of 2019 and, come November of 2020, pays the county the new higher re-assessed property taxes. Come January 2024, when borrowers get mortgage escrow analysis. Mortgage escrow will increase due to the increase in property taxes.

Property Tax Increases

This can be unclear, so an example is the best way to explain this. For example, if property taxes have increased by $3,600. That means an additional monthly payment towards property taxes will be $300.00. The homeowner must pay an additional $300.00 monthly for the coming year. Dale Elententy of Non-QM Mortgage Brokers explains why monthly housing payments increase during the mortgage loan term.

Homeowners will have the same fixed principal and interest for the term of the mortgage loan. However, the property tax and homeowners insurance can increase. If the property tax and homeowners insurance increase, the monthly housing payment will increase because the escrow account will need to increase.

If the homeowner had a shortage of $3,600 for the prior year’s property taxes, since property taxes are always paid in arrears. This means the mortgage lender will escrow the prior year’s monthly shortage of $300.00. The coming year’s additional $300.00 per month for $600.00 in increased mortgage escrow. This type of payment shock in escrow can devastate a homeowner, especially those on a fixed income.

Solutions For Those Who Have Payment Shock Increase

Homeowners with a sharp property tax hike and mortgage escrow have gone up significantly and have trouble paying for it; contact the lender immediately and explain your situation to them.

The mortgage lender can offer borrowers various options. Contact them before getting behind on mortgage payments. They are more options to help borrowers when they are current.

One of the options lenders may do is to spread out mortgage escrow payments to alleviate borrowers from the sudden payment shock. Another option may be to contact the county and see if they have any hardship programs to reduce property taxes. Many counties have special programs to cap property taxes on the elderly, disabled, or those with fixed incomes.

Increases of Mortgage Escrow Due To Homeowners Insurance Premium Increase

Homeowners’ insurance premiums can increase like property taxes, increasing the escrow balance account. For example, for homeowners who filed homeowners insurance claims on their homes, the chances are that homeowners insurance premiums will go up. If the mortgage lender does not catch the increase in homeowners insurance premiums until the next mortgage escrow analysis cycle, homeowners are most likely due to a payment shock.

Non-QM Mortgage Brokers is a mortgage lender licensed in 48 states, including Washington, DC, Puerto Rico, and the U.S. Virgin Islands. We have a lending network of 210 wholesale lenders. Over 80% of our clients at Non-QM Mortgage Brokers are borrowers who could not qualify at other mortgage companies.

Homebuyers who need to qualify for a mortgage with a lender with no lender overlays on government and conventional loans can contact us at Non-QM Mortgage Brokers at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Non-QM Mortgage Brokers is available seven days a week, evenings, weekends, and holidays.