Re-Establishing Credit With Secured Credit Cards

This guide will cover re-establishing credit with secured credit cards to qualify for a mortgage. Qualifying for a home loan is not as difficult as many people think. Most homebuyers think they need a large down payment and good credit to qualify for a mortgage loan. Lenders do realize that many folks may have gone through periods of hardship due to the following:

- Loss of business

- Loss of employment

- Gaps in employment

- Divorce

- Medical Issues

- Were victims of the Great Recession of 2008

- Other extenuating circumstances

FHA and VA Mortgages For Home Buyers

FHA and VA loans are the best loan programs for homebuyers with previous credit issues. Unfortunately, not everyone can qualify for VA Loans. VA loans are restricted to U.S. military veterans with a valid Certificate of Eligibility. You do not have to pay outstanding collections and charge off accounts to qualify for FHA loans. However, lenders want re-established credit to qualify for mortgage borrowers.

Ways of Re-Establishing Credit To Qualify For Mortgage

You need a good credit history to establish good credit to get good mortgage rates and interest rates on credit cards, automobile loans, and other installment loans. If you have no credit history at all, it is easy to reestablish your credit.

Opening a bank account is the simplest and safest way to manage your finances. By opening a savings or checking account, consumers can build good credit by saving money and earning interest, easily paying bills, and tracking expenses on time. Responsible use of a checking account or an Automatic Teller Machine (ATM) card will reflect favorably in the credit report.

If you had prior bad credit, opening a bank account would be a great way of re-establishing credit. If consumers have services in their name (telephone, gas, and electric), pay them in full and on time. Pay any loans and credit accounts on time each month. At least pay the minimum, if there is one. This will be another way of reestablishing credit.

Tips on Re-Establishing Credit For Mortgage Approval After Bankruptcy and Foreclosure

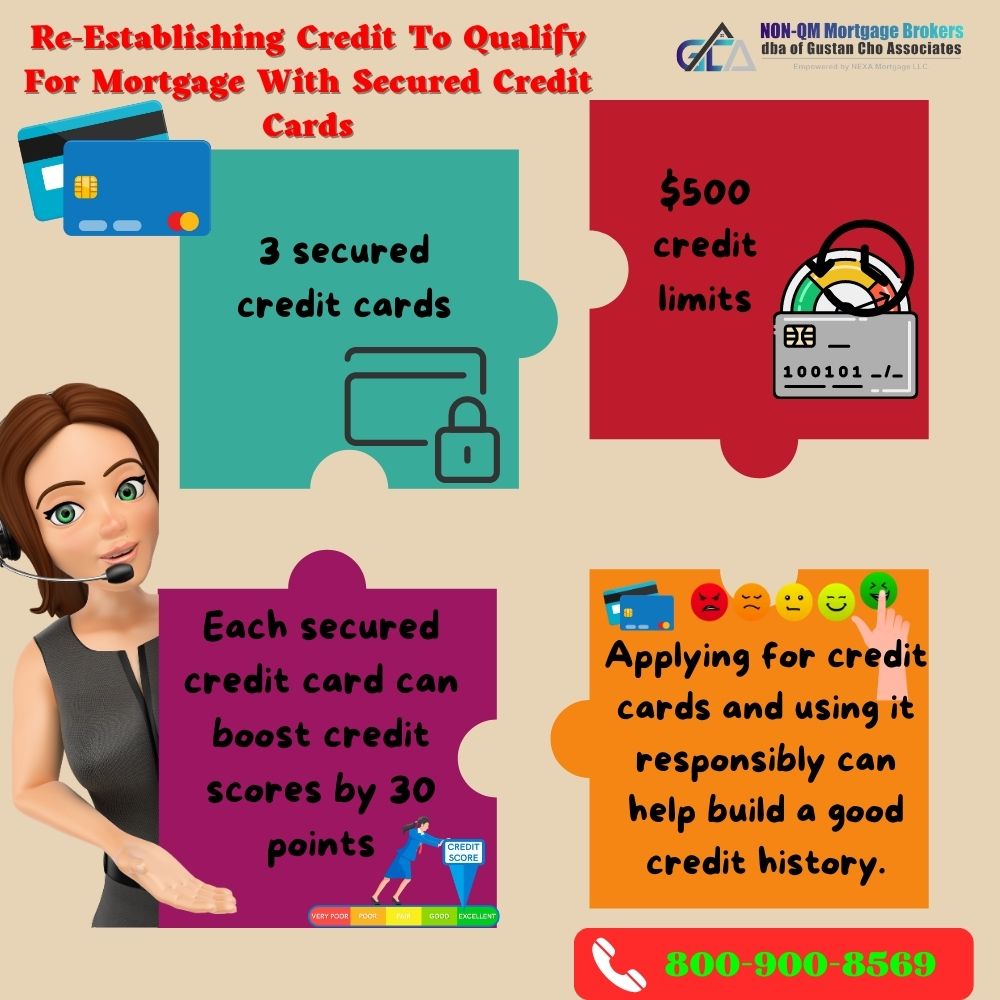

Re-establishing credit to qualify for a mortgage after bankruptcy or foreclosure can be done. Dale Elenteny of Non-QM Mortgage Brokers advises the best way to re-establish credit after bankruptcy and a foreclosure is to get three to five secured credit cards. This is what Dale advises:

The best way of re-establishing credit after bankruptcy or foreclosure is by getting three secured credit cards with $500 credit limits. Each secured credit card can boost credit scores by 30 points. So three credit cards with $10 balances can substantially increase one’s credit score. Applying for credit cards and using them responsibly can help build a good credit history.

Borrowers denied credit cards may want to investigate getting secured credit cards. They deposit a pre-determined amount of money with the credit card provider. The secured card can be used similarly to a regular unsecured credit card with the same convenience and payment flexibility. Gasoline companies and retail stores also offer credit cards.

FHA Loans With Bad Credit

Borrowers can qualify for FHA loans with bad credit. However, lenders want to see that borrowers have re-established their credit. Borrowers do not have to pay off outstanding collections and charge-offs to qualify for FHA loans. Here are the basic FHA Loan Requirements:

- Minimum 580 credit scores.

- Outstanding collections and charge-off Accounts do not have to be paid to qualify for FHA loans.

- 3.5% down payment.

- Borrowers can qualify for FHA loans two years after the Chapter 7 Bankruptcy discharge date.

- Borrowers can qualify for FHA loans three years after a deed-in-lieu of foreclosure, short sale, or foreclosure.

- Lenders want to see re-established credit after bankruptcy or foreclosure.

Credit Disputes During Mortgage Application Process

A loan officer should not issue a pre-approval letter to borrowers on an FHA loan if they have credit disputes during the mortgage application process. HUD does not allow credit disputes on non-medical collection accounts with aggregate outstanding balances of $1,000 or more.

Homebuyers can increase credit scores by getting three to five secured credit cards. Three to five secured credit cards can increase credit scores anywhere between 60 to 150 points. Disputing medical collections can also increase credit scores.

Credit disputes on a non-medical collection account are less than $1,000 on one’s credit report, and zero balance disputes are allowed. Credit disputes on medical collection account with outstanding balances are exempt and can be disputed.. Credit disputes on charge-off accounts are not allowed. Must be retracted for the mortgage process to proceed under HUD Guidelines.

Re-Establishing Credit To Qualify For Mortgage With Collections and Charge-Off Accounts

HUD does not require outstanding and collection accounts with outstanding balances to be paid off to qualify for FHA loans. Many lenders require collections and charge-off accounts to be paid off for borrowers to qualify for FHA loans. John Strange of Non-QM Mortgage Brokers advises getting three to five secured credit cards to increase credit scores to qualify for an FHA loan.

The fastest way to increase credit scores to qualify for an FHA loan is to get three to five secured credit cards with at least a $500 credit card limit.

This is not a HUD guideline but a lender overlay on the individual lender. If a lender requires borrowers to have collections or charge-offs to be paid, contact us at Non-Qm Mortgage Brokers. We do not have any FHA lender overlays and will go off HUD Guidelines on collections and charge-off accounts.

Re-Establishing Credit To Qualify For Mortgage With Non-Medical Collections

There is one rule with non-medical collections. Suppose borrowers have non-medical collections with over $2,000 aggregate outstanding balance. In that case, HUD requires the underwriter to take 5% of the outstanding balance of all collections and use it in the borrower’s debt-to-income ratio calculations.

Borrowers do not have to pay this amount. The mortgage underwriter need to use this hypothetical debt for qualifying income. It is a hypothetical debt for debt-to-income ratio calculations. If the 5% of the outstanding non-medical collection account exceeds the maximum debt-to-income ratio requirements to qualify for an FHA loan, borrowers can enter into a written payment agreement with the creditor. Whatever the monthly payment is agreed upon, that number will be used instead of the 5%.

Don’t forget that secured credit cards is the easiest and fastest way of rebuilding credit to qualify and get approved for a mortgage loan. It will only take two to three months to rebuild and increase credit scores with secured credit cards. Borrowers needing to qualify for a mortgage with a mortgage broker licensed in 48 states, including Washington, DC, Puerto, and the U.S. Virgin Islands, with no overlays on government and conventional loans, please us at Non-QM Mortgage Brokers at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Non-QM Mortgage Brokers is available seven days a week, evenings, weekends, and holidays.