FHA Loans With Charge-Offs

Can you qualify for FHA loans with charge-offs? Do you have to pay charge-offs to qualify for FHA loans with charge-offs? One of the most common questions is, do you have to pay a charge-off to qualify for FHA loans with charge-offs?

Per HUD agency guidelines, borrowers can qualify for FHA loans with charge-offs and collection accounts without having to pay the outstanding balance of the debt.

HUD does not require borrowers to pay off charge-off accounts and collection accounts for borrowers to qualify for FHA loans. Charge-offs and medical collection accounts do not matter and do not matter in the calculations of the borrower’s debt-to-income ratios. Many mortgage loan originators tell borrowers with charge-off accounts that they do not qualify for FHA loans with charge-offs.

What If I am Told To Pay Unpaid Charge-Off Accounts By a Lender?

A frequently asked question at Non-Qm Mortgage Brokers do you have to pay the outstanding debts with the creditor to qualify for FHA loans with charge-offs and collection accounts. Per HUD agency guidelines, charged-off accounts do not have to be paid to qualify for an FHA loan.

Loan officers instruct borrowers to pay off their charge-off accounts to qualify for an FHA loan. This is not true. Sometimes, paying off a charge-off account may create more damage than good, especially with paying off a second mortgage charge-off account.

In this article, we will discuss and cover do you have to pay charge-offs with FHA loans. In the following paragraphs, we will detail the frequently asked question of do you have to pay charge-offs with FHA loans.

Do You Have To Pay Charge-Off To Qualify For FHA Loans With Charge-Offs

A charge-off account is a collection account that a creditor has tried to collect on but eventually gave up on collecting on the collection account and has written the debt off their books. Just because a creditor has charged off an account does not mean that the consumer is debt-free and that the debt is forgiven.

Sometimes, a charge-off account that has been dormant for quite some time becomes reactivated. The creditor can hire a collection agency and sells the charge off the account to a collection agency.

The collection agency will aggressively go after the consumer trying to collect on the charge-off account. Most times, if the creditor sees that it is next to impossible to collect on the consumer. Because they feel that the consumer is judgment-proof or has little or no assets and limited income, they will not pursue collection activity on charge-off accounts.

Statute of Limitations on Bad Debt

A consumer is free and clear from any liabilities on charge-off accounts after they pass the statute of limitations period on the particular state where the debt was initiated.

Most states have a statute of limitations on consumer debt for five years. Consumers need to check on each state’s statute of limitations. Each state has its own and separate statute of limitations on debt.

Some collection agencies are ruthless and will try to collect on collection accounts and charge off accounts even after the statute of limitations period has expired. Most states have a statute of limitations on judgments for ten years. A judgment creditor can renew a judgment for another ten years after the statute of limitations on the judgment has expired.

How Do Charge-Offs Report on Credit Reports

All charge-offs will report on all three credit bureaus;

- Experian

- Equifax

- Transunion

Charge-offs will report on consumer credit reports with a balance on the charge-offs. Unfortunately, many mortgage loan officers still do not know how to read credit reports. I get many phone calls from skeptical borrowers who were told not to count a charge-off account to qualify for an FHA loan. They are told the charge-off needs to be zero balance. The zero balance needs to be reported on the consumer’s credit report. There is no such thing.

Why Does One Lender Says Pay and A Different Lender Say Not To Pay Charge-Offs

Not all lenders have the same lending requirements on charge-offs. One lender will tell you to pay outstanding charged-off accounts, while another will tell you you do not have to pay. Per HUD Guidelines, you do not have to pay outstanding charged-off accounts. Lenders telling you to pay charge-offs because the lender has overlays. Lender overlays are additional mortgage requirements above and beyond HUD’s minimum agency mortgage guidelines.

To Buy a House Do, You Have To Pay Charge-Offs With FHA Loans

All charge-offs will report with a credit balance. This is because the outstanding balance reported on the credit report is the amount the creditor has charged-offs. Again, with HUD, an FHA applicant does not have to pay off a charge-off. Charge-off and collection accounts do not have to be paid off to qualify for an FHA loan.

Best Mortgage Lenders For Bad Credit With No Overlays on Charge-Offs

If you are told that you need to pay off a charge-off account by a mortgage lender, don’t hesitate to contact us at Non-Qm Mortgage Brokers at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com, and I will be able to help you. Again, do not pay off any charge-off accounts or collection accounts if you have them on your credit report and need to qualify for an FHA loan.

FHA Loans With Charge-Offs Versus Mortgage Charge-Offs

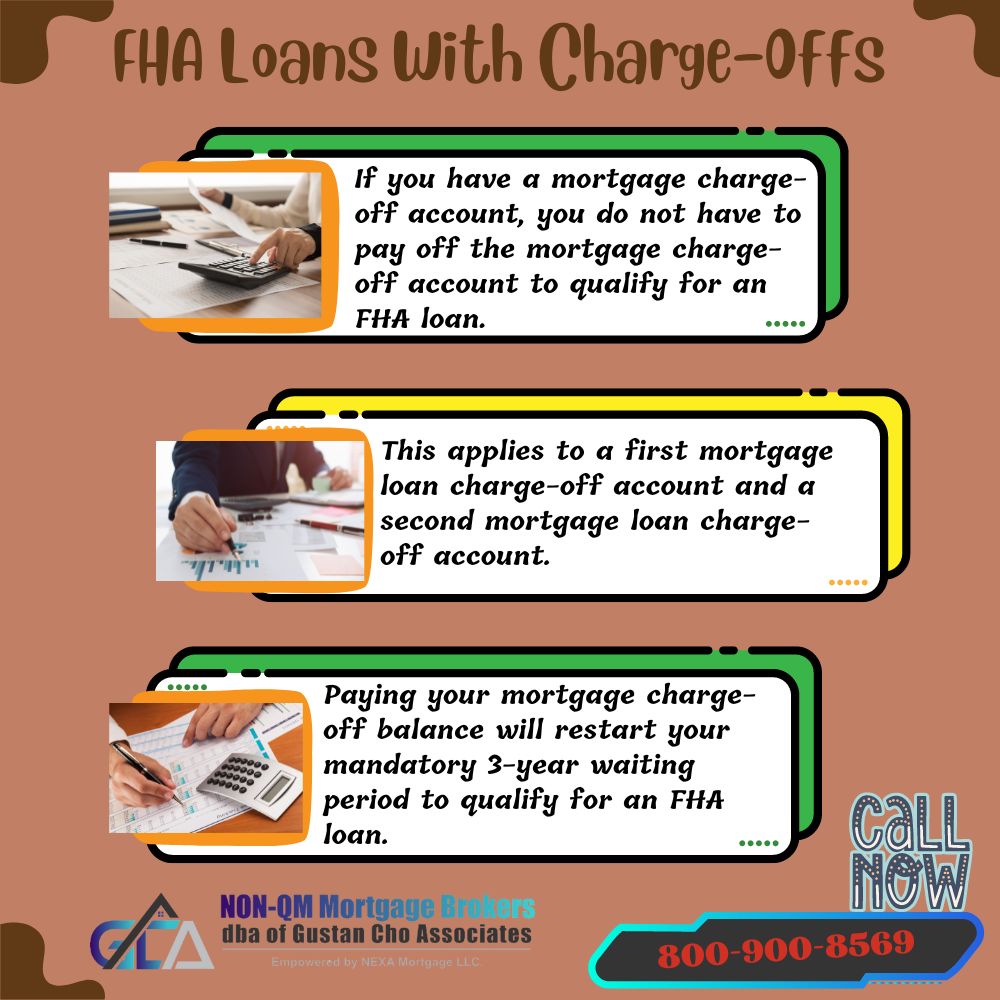

If you have a mortgage charge-off account, you do not have to pay off the mortgage charge-off account to qualify for an FHA loan. This applies to a first mortgage loan charge-off account and a second mortgage loan charge-off account. Paying off a mortgage charge-off account will set you back big time.

How these works are for FHA loans, there is no waiting period after a second mortgage charge-off. There is a three-year waiting period to qualify for FHA loans after the first mortgage charge-off. The waiting period is three years of the first mortgage charged-off date, reflected on the consumer’s credit report, or three years from the charge-off settlement date.

If you pay off a mortgage charge-off, whether a first mortgage charge-off or second mortgage charge-off, there is a three-year waiting period from the settlement date of the mortgage charge-off date.

HUD Agency Guidelines on Mortgage Charged-Off Accounts on FHA Loans

All mortgage charge-off accounts have an outstanding balance reporting on the consumer’s credit report, so do not worry about that.

Many borrowers who come to me were told by another mortgage loan originator that there is an outstanding balance reporting on the mortgage charge-off. That they need to pay off the mortgage charge-off outstanding balance to qualify for an FHA loan.

Again, that is not the case. Paying your mortgage charge-off balance will restart your mandatory 3-year waiting period to qualify for an FHA loan.

Fannie Mae Guidelines on Mortgage Charged-Off Accounts on Conventional Loans

The same goes with Fannie Mae and Freddie Mac mortgage lending guidelines with a first and second mortgage charge-off.

With Conventional loans, there is a four-year mandatory waiting period after a first and second mortgage charge-off from either the reported date of the charge-off or the date the mortgage charge-off account was settled, whichever is later.

If you have a mortgage charge-off account, whether it is a first or second mortgage, there is a four-year waiting period to qualify for a Fannie Mae or Freddie Mac Conventional loan. However, suppose you settle the first or second mortgage charge-off account later after the original mortgage charge-off date. In that case, your four-year waiting period will restart from the settlement date of your first or second mortgage charge-off date.

How Do I Qualify For a Mortgage With Derogatory Credit Tradelines

Again, if you have charged-off accounts or outstanding collection accounts, don’t hesitate to contact us at Non-Qm Mortgage Brokers at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.

Non-QM Mortgage Brokers, empowered by NEXA Mortgage, LLC are mortgage brokers licensed in 48 states including Washington, DC, Puerto Rico, and the United States Virgin Islands with 210 wholesale lending partners. We have a national reputation for being able to qualify and approve borrowers other lenders cannot do.

Non-Qm Mortgage Brokers is a direct national lender with no overlays. Most of our borrowers could not qualify from other banks or lenders due to their mortgage lender overlays or being told the wrong information. I am available seven days a week, evenings, weekends, and holidays.

This BLOG on FHA loans with charge-offs Was UPDATED on January 24th, 2023.