FHA Guidelines on Employment Gaps and Job Seasoning Requirements

This article will cover FHA guidelines on employment gaps and job seasoning requirements once borrowers return to work. FHA guidelines on employment gaps allow gaps in employment to qualify for FHA loans. One of the questions asked by lenders is two-year employment history. Most mortgage lenders require borrowers employed for two years in the same job.

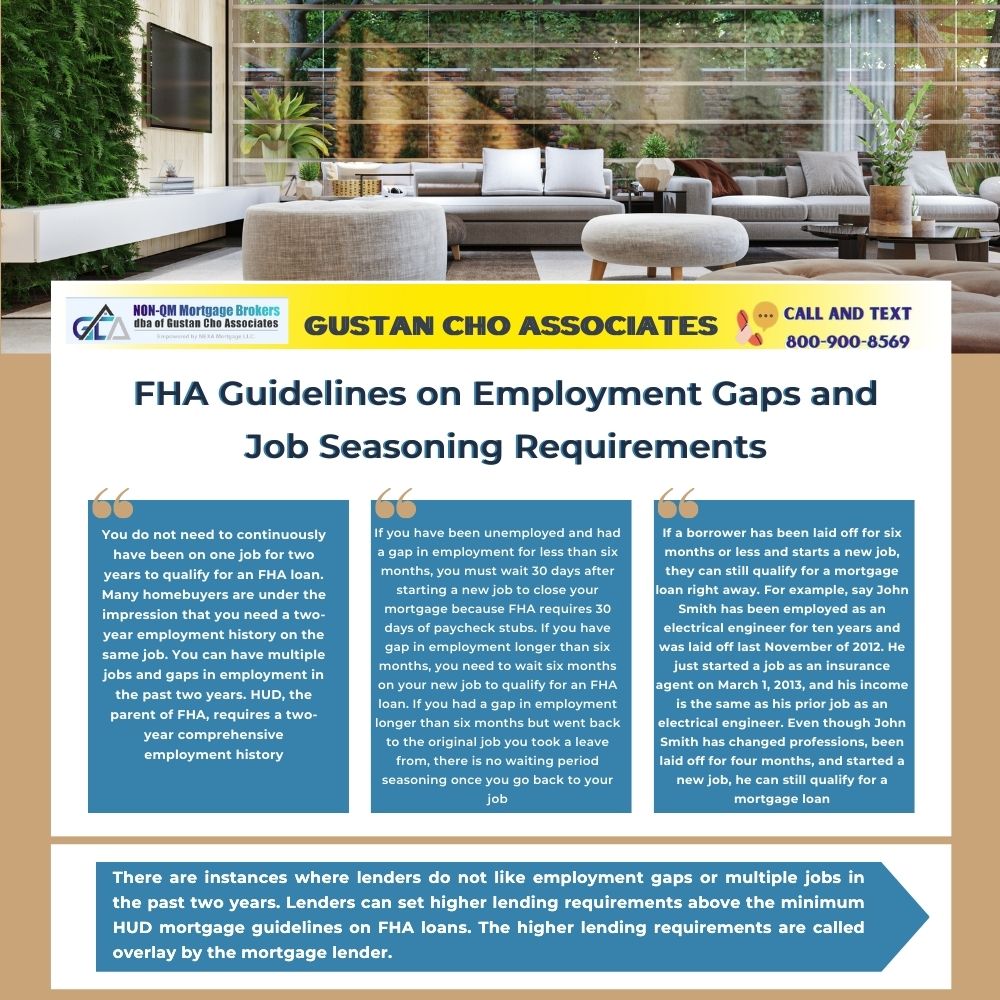

You do not need to continuously have been on one job for two years to qualify for an FHA loan. Many homebuyers are under the impression that you need a two-year employment history on the same job. You can have multiple jobs and gaps in employment in the past two years. HUD, the parent of FHA, requires a two-year comprehensive employment history.

FHA guidelines on employment gaps only require a comprehensive two-year employment history. Gaps in employment are allowed. Borrowers can qualify for a mortgage loan even if they change jobs in the past two years.

If you have been unemployed and had a gap in employment for less than six months, you must wait 30 days after starting a new job to close your mortgage because FHA requires 30 days of paycheck stubs. If you have gap in employment longer than six months, you need to wait six months on your new job to qualify for an FHA loan. If you had a gap in employment longer than six months but went back to the original job you took a leave from, there is no waiting period seasoning once you go back to your job.

Allowed to have a brief period of unemployment. Job longevity shows stability. However, lenders do understand that temporary unemployment and job changes happen. In the following paragraphs, we will cover FHA guidelines on employment gaps.

Income Documents Required In the Mortgage Process

One of the requirements to qualify for a mortgage loan is to show proof of two years of tax returns and two years of W2s. If a borrower has been laid off in the past two years, they may still qualify for a mortgage loan.

If a borrower has been laid off for six months or less and starts a new job, they can still qualify for a mortgage loan right away. For example, say John Smith has been employed as an electrical engineer for ten years and was laid off last November of 2012. He just started a job as an insurance agent on March 1, 2013, and his income is the same as his prior job as an electrical engineer. Even though John Smith has changed professions, been laid off for four months, and started a new job, he can still qualify for a mortgage loan.

As long as mortgage underwriters feel that their current job as an insurance agent is stable and they can prove that they will be employed with the same company, they qualify for a mortgage. The fact that he is making the same amount of money as he did previously as an electrical engineer would be an even greater benefit. If John Smith was laid off for more than six months, there are different mortgage underwriting requirements regarding job longevity.

Gaps In Employment Mortgage Guidelines

If John Smith had been laid off for more than six months and started his new job as an insurance agent, there is a six-month job longevity requirement before he can apply for a mortgage loan. For example, here is a case scenario:

- if John Smith was laid off as an electrical engineer on July 1, 2012

- and just started his new job as an insurance agent on March 1, 2013

John Smith would not qualify for a mortgage loan until he has been on his new job for at least six months. He will qualify once he has worked as an insurance agent for at least six months which will be September 2013. Lenders want job longevity because they want to ensure that the mortgage loan borrower is stable and will continue being employed in the future.

Lender Overlays on FHA Guidelines on Employment Gaps

There are instances where lenders do not like employment gaps or multiple jobs in the past two years. Lenders can set higher lending requirements above the minimum HUD mortgage guidelines on FHA loans. The higher lending requirements are called overlay by the mortgage lender.

Non-QM Mortgage Brokers, empowered by NEXA Mortgage, LLC, are mortgage brokers licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands, with wholesale lending partners with no lender overlays on FHA loans.

Lender overlays are guidelines imposed by lenders in addition to the minimum HUD Guidelines. GCA Mortgage Group specializes in government and conventional loans with no lender overlays. Home buyers and homeowners who have any questions on job longevity and mortgage qualification, please get in touch with us at 1-800-900-8569 or text us for faster response. Or email us at gcho@gustancho.com. The team at Non-QM Mortgage Brokers is available seven days a week, evenings, weekends, and holidays. The team at Non-QM Mortgage Brokers are experts in non-QM and alternative mortgage lending programs.