Getting a Mortgage After Bankruptcy

In this guide in Non-QM Mortgage Brokers, we will cover and discuss qualifying for a mortgage after bankruptcy for borrowers on home purchase and refinance transactions. Government-backed loans and conventional loans have mandatory waiting period requirements to qualify for a mortgage after bankruptcy.

To get a conventional mortgage that meets the requirements from Fannie Mae and Freddie Mac that many lenders follow, you’ll typically have to wait four years from the bankruptcy discharge or dismissal before getting a mortgage if financial mismanagement caused your bankruptcy.

Non-QM Mortgage Brokers empowered by NEXA Mortgage, LLC is licensed in 48 states including Washington DC, Puerto Rico, and the U.S. Virgin Islands, and is the largest and fastest mortgage broker in the United States.

Waiting Period Requirement To Qualify For a Mortgage After Bankruptcy

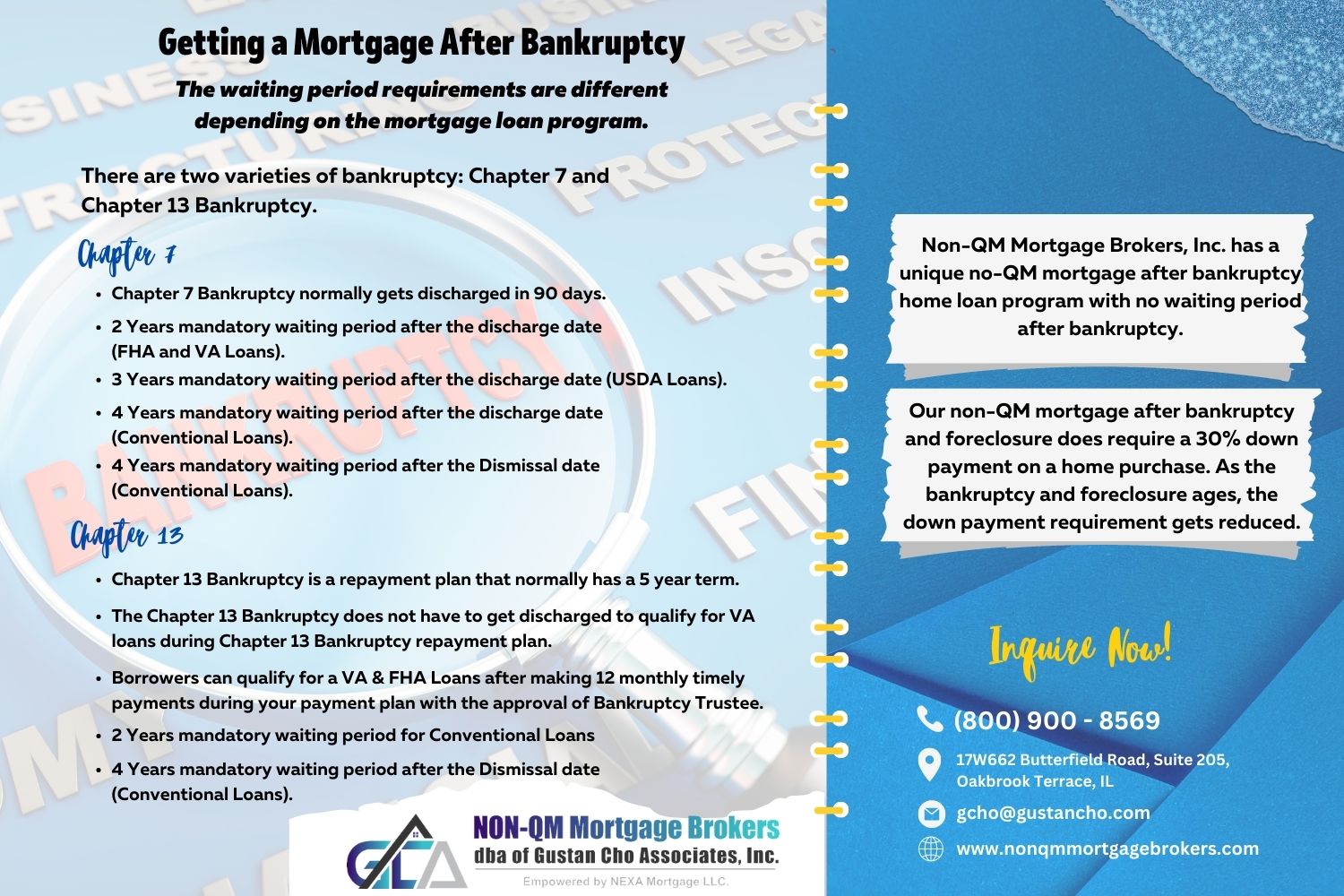

The waiting period requirements are different depending on the mortgage loan program. Non-QM Mortgage Brokers has a unique no-QM mortgage after bankruptcy home loan program with no waiting period after bankruptcy.

If you experience extenuating circumstances, such as a job loss, illness or death of the primary owner, your lender may shorten the waiting period.

Our non-QM mortgage after bankruptcy and foreclosure does not have a waiting period requirement but does require a 30% down payment on a home purchase. As the bankruptcy and foreclosure ages, the down payment requirement gets reduced.

What Is Bankruptcy?

Bankruptcy is a federal law that protects consumers, businesses, and corporations from creditors when they are under financial stress. Bankruptcy occurs when someone (man, woman, business, corporation) falls behind on their debt payments and needs to seek relief from the U.S. Bankruptcy Courts.

How Hard Is It To File Bankruptcy?

Bankruptcy can happen to the best of us. You’ll additionally be required to attend a bankruptcy course before you are able to file bankruptcy as part of the bankruptcy procedure. It is an online course about debt management.

When you file for bankruptcy protection, a discharge from the court will relieve you of your obligation to repay your creditors for certain debts. As noted, once your debt is discharged, your creditors cannot contact you or attempt to collect the debt in any way.

Chapter 7 Bankruptcy gets discharged in 90 days after filing. Chapter 13 Bankruptcy is a repayment plan and can take up to five years before it gets discharged.

How Serious Is Filing For Bankruptcy

There are instances when people cannot pay off their debts due to a job loss, loss of business, divorce, or illness. When there is a disruption of income, most folks cannot make their monthly debt payments.

Financial disruption in one’s life can affect everyone. This is regardless of age, earnings, social status, educational level, gender, or occupation. Often unexpected instances like unemployment, redundancy, or an uninsured loss can severely impact your financial condition.

Why Do People File For Bankruptcy?

What takes place you come to be bankrupt? Suppose you locate yourself in a state of affairs where you’re incapable of paying your debts. In that case, you could claim bankruptcy voluntarily (financial disaster). Alternatively, legal proceedings may be taken in opposition to a man or woman or an employer via means of a creditor within the hopes of recouping the cash owed.

Relief From Bankruptcy

Bankruptcy can make you come up with a new start. However, it may also harm your credit score, making it tough to get a mortgage loan. Here’s what is involved in getting a loan after bankruptcy and the way to grow your possibilities of qualifying for a mortgage.

Why it may be hard to get a loan after bankruptcy.

Types of Mortgage After Bankruptcy Options For Consumers

There are two varieties of bankruptcy: Chapter 7 and Chapter 13 Bankruptcy. The former is very common and entails a liquidation. Chapter 7 Bankruptcy is also referred to as total liquidation bankruptcy. Chapter 7 Bankruptcy benefits consumers without any assets to protect and/or unstable jobs or those who are unemployed.

What Is Chapter 7 Bankruptcy?

Chapter 7 Bankruptcy means maximum or all your fantastic debt is discharged.

Chapter 7 Bankruptcy provides relief to debtors regardless of the number of debts owed or whether a debtor is solvent or insolvent. A Chapter 7 Trustee is appointed to convert the debtor’s assets into cash for distribution among creditors.

A Chapter 7 bankruptcy is commonly accredited for people with restricted earnings to pay off what they owe. A Chapter 7 Bankruptcy is normally discharged after 90 days after the filing date.

What Is Chapter 13 Bankruptcy?

Chapter 13 Bankruptcy is called a “reorganization bankruptcy.” Chapter 13 Bankruptcy is when you have a regular continuous source of income or full-time job.

A chapter 13 bankruptcy is also called a wage earner’s plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.

You need to have a consistent source of income to be eligible for Chapter 13 Bankruptcy. People who file Chapter 13 Bankruptcy normally have assets to protect such as a house, real estate, car, or other assets of value.

Chapter 13 Bankruptcy Repayment Plan

Chapter 13 Bankruptcy has the court system help you create a plan to pay off your creditors at a reduced rate based on your income. A percentage of your income is taken out of your earnings. The percentage that is taken is used to distribute payment to your creditors accordingly by the Bankruptcy Trustee.

How Does The Chapter 13 Bankruptcy Process Work?

Chapter 13 Bankruptcy is a repayment plan of 3 to 5 years. The trustee of the bankruptcy courts oversees the debt restructuring. A percentage of the petitioner’s debts will be allocated toward paying creditors. The creditors get paid through the repayment plan. Once the repayment plan of three to five years is completed, the remaining debts are discharged by the U.S. Bankruptcy Courts. A bankruptcy trustee is appointed to the petitioner.

Does Bankruptcy Ruin Your Credit?

Both types of bankruptcy can negatively affect your capacity to get a loan. However, the team at Non-QM Mortgage Brokers have helped thousands of homebuyers rebuild and re-establish credit after bankruptcy. We can help borrowers rebuild credit after bankruptcy and get their credit score to over 700 in less than one year of discharge date.

Rebuilding Your Credit For Mortgage After Bankruptcy

Chapter 7 and Chapter 13 Bankruptcy can drop your credit the minute the bankruptcy is filed. That’s because Chapter 7 or 13 remains on your credit score record for ten years or as many as seven years, respectively, from filing. However, as the bankruptcy ages, your credit scores will go up. Rebuilding your credit after bankruptcy will boost your credit scores.

How Soon Can I Get a Mortgage After Bankruptcy?

First, let’s speak about the two types of client bankruptcy: Chapter 7 and Chapter 13 Bankruptcy. We’ll additionally show you how long you need to wait before you would possibly qualify for positive loan types. One of the frequently asked questions at Non-QM Mortgage Brokers is How Soon Can I Purchase a House After Bankruptcy.

Waiting Period Requirements To Qualify For Mortgage After Bankruptcy

Depending on the loan you qualify for, your lender, the type of bankruptcy you declared, and the reason for your bankruptcy, you may wait for 1 to 4 years after submitting bankruptcy. You may also wait until your credit score rating has recovered sufficiently, which is an excellent way to qualify for a mortgage after bankruptcy with a great mortgage rate.

How Long Do I Need To Wait To Get Mortgage After Chapter 7 Bankruptcy?

A Chapter 7 Bankruptcy, or liquidation bankruptcy, discharges your debts after 90 days of the filing date. Chapter 7 Bankruptcy stays on your record for 10 years from the filing date. However, that doesn’t mean you must wait ten years to qualify for a loan. You can start rebuilding your credit immediately after the discharge date of your Chapter 7 Bankruptcy. The best and easiest way to rebuild your credit after your Chapter 7 Bankruptcy discharge date is by getting three to five secured credit cards.

Mortgage Guidelines After Chapter 7 Bankruptcy on Government and Conventional Loans

Homebuyers can get an FHA and VA loan two years after the Chapter 7 Bankruptcy discharge date. FHA loans require a 3.5% down payment. You can get a VA loan with no money down. The waiting period is two years from the discharge date of the Chapter 7 Bankruptcy.

USDA loans require a three-year waiting period after Chapter 7 Bankruptcy. Fannie Mae and Freddie Mac require a four-year waiting period after Chapter 7 Bankruptcy. Traditional jumbo loans normally require a seven-year waiting period after the Chapter 7 Bankruptcy discharge date.

Fannie Mae Guidelines on Mortgage After Bankruptcy

To get a conventional loan that meets the requirements from Fannie Mae and Freddie Mac that many creditors follow, you’ll generally wait four years from the Chapter 7 bankruptcy discharge date or dismissal earlier than getting a loan if economic mismanagement triggered your bankruptcy.

Dismissal way you petitioned the court to assist you in input bankruptcy, and they decided you probably did not qualify.

Discharge in a chapter 7 bankruptcy commonly happens approximately four months after submitting.

However, the waiting duration is going down to 2 years if you could report extenuating situations that brought your bankruptcy.

How Bankruptcy Can Affect Your Potential to Get a Mortgage?

Qualifying for a mortgage after bankruptcy is more than possible. A bankruptcy can extensively decrease your credit scores. A bankruptcy will continue to be on your credit report for ten years from the filing date. Bankruptcy may affect your cap potential to gain a credit score, which includes a mortgage loan, for up to ten years. Fortunately, its impact lessens over time.

For a lender to even recollect you for a loan after bankruptcy, your bankruptcy needs to be discharged. A bankruptcy dispense is a court order that gets rid of your debts. In addition to ensuring your default has been released, a lender will study your credit score record to decide your creditworthiness. It’s a perfect idea to test your credit score record before you apply for a domestic mortgage to ensure it is accurate.

Monitor Credit Report To Get Mortgage After Bankruptcy For Errors

Look for errors with wrong or old statistics or bills that were not included in your bankruptcy filing, which can be listed as a part of it. Be positive to contact the credit score company as quickly as possible and dispute any mistakes you discover. When you start to apply for a loan after bankruptcy, your lender will probably ask you some questions about your bankruptcy.

Mortgage lenders may also ask you when your case is discharged, what you’ve performed to set up a new credit score, and how you’ve been maintaining your bills. It’s a perfect idea to have the answers to those questions prepared in advance for the utility procedure to run smoothly.

What Types of Mortgage After Bankruptcy Options Are There?

What kind of loan are you able to get after bankruptcy? After bankruptcy has been discharged and closed, you will be eligible for a traditional loan in addition to an FHA, VA, or USDA mortgage in case you qualify. “But you’ll want to satisfy the ready waiting rule and display which you’ve labored to restore your credit score,” Your credit score rating and the quantity you’ll be capable of deciding to a down charge (many creditors pick 20 percent) will have an effect on the interest charge you’re quoted. For an FHA mortgage, you’ll want to illustrate that you have progressed your credit score and haven’t taken on any extra debt because of the financial disaster.

This blog on Mortgage after Bankruptcy was updated and published on November 10th, 2022.