Can I Buy a House With VA Loans With 580 Credit Scores

In this article, we will cover and discuss qualifying for VA loans with 580 credit scores. Active duty and retired eligible veterans with a VA certificate of eligibility do not realize that they can get qualified for VA loans with 580 credit scores. Actually, the U.S. Department of Veteran Affairs has no minimum credit score requirements for VA loans. We will cover qualifying for VA loans with low credit and discuss the basic agency mortgage guidelines.

What Are VA Loans and How Do The VA Mortgage Process Work?

The Veterans Affairs created very lenient mortgage guidelines on VA loans. There are no maximum debt-to-income ratio caps on VA loans.

The team at Non-QM Mortgage Brokers are experts in helping veterans qualify and be approved for VA loans with credit scores down to 500 FICO. In the following paragraphs, we will be covering VA loans with 580 credit scores.

The Importance of Timely Payments in The Past 24 Months

In order to get approve/eligible per Automated Underwriting System Findings, borrowers need to have been timely on all of their monthly payments reporting on the three credit bureaus for the past 12 months. The U.S. Department of Veterans Affairs is the federal government agency that administers the mortgage guidelines on VA loans. There are two types of VA Guidelines:

- VA Guidelines

- Lender Overlays

Qualify And Get Pre-Approved Today. Click here

Understanding VA Agency Guidelines Versus Lender Overlays On VA Loans

All VA Lenders need to have their veteran borrowers meet the minimum VA Guidelines by the U.S. Department of Veterans Affairs (VA) if they want the VA to insure the VA loans they originate and fund. However, each individual mortgage lender can have higher lending requirements and guidelines that are above and beyond the minimum VA agency guidelines on VA loans.

VA Loans With Bad Credit

Many VA lenders will not accept borrowers under a certain credit score or a certain debt-to-income ratio cap. Lenders overlays are optional for higher lending requirements by the mortgage lender. It is up to the lender to the types of overlays they want to implement. Individual lenders will have overlays on factors they feel are too high-risk for them.

Qualify And Get Pre-Approved Today. Click here

Not All Lenders Have The Same VA Credit Requirements On VA Loans

Not all mortgage companies have the same type of overlays. Some lenders may have overlays on requiring all outstanding collections and/or charged-off accounts to be paid off while other lenders may have a limit on the maximum outstanding collections and/or charged-off accounts borrowers can have.

VA Loans With 500 Credit Scores

Some lenders may require a 620 credit score while a different lender may require a 660 credit score. Non-QM Mortgage Brokers is a mortgage company licensed in multiple states with no lender overlays on VA loans. In the following subparagraphs, we will be discussing the common overlays imposed by individual lenders.

Qualify And Get Pre-Approved Today. Click here

VA Loans With Low Credit Scores

Overlays On Credit Scores: VA does not have a minimum credit score requirement on VA loans. As long as the borrower can get approve/eligible per the automated underwriting system (AUS), there is no minimum credit score requirement. If the borrower cannot get an automated approval via AUS and gets a refer/eligible per AUS findings, the borrower may qualify for a manual underwrite. However, the borrower needs to meet VA manual underwriting guidelines.

Mortgage Guidelines on Timely Payments

One of the main factors in manual underwriting on VA loans is the borrower needs timely payments in the past 24 months. Non-QM Mortgage Brokers will make an exception for our veterans and will approve manual underwriting with 12 months of timely payments versus 24 months. Many lenders require a 620 or higher credit score requirement although the Veterans Administration does not require any minimum credit scores. This is called VA Lender Overlays On Credit Scores by the individual mortgage lender.

VA Loan Requirements On Debt-To-Income Ratios

Overlays On Debt To Income Ratios: Most lenders require a cap on the debt-to-income ratio on veteran borrowers as part of their lender overlays. The Veterans Administration does not have a maximum limit cap on debt-to-income ratios on VA loans. Non-QM Mortgage Brokers closes a substantial percentage of our VA loans for borrowers with under 580 FICO and over 60% debt-to-income ratio. The key to getting AUS approval on VA loans with a high debt-to-income ratio is strong residual income.

Contact Us To Qualify And Get Pre-Approved. Click here!!!

VA Loans With Collection And Charged-Off Accounts

Overlays On Collections And Charge Offs are very common by VA lenders. Many lenders require that charged-off and collection accounts are paid off on VA loans. Veteran borrowers can qualify for VA Home Loans with outstanding charges offs and collections without having to pay them off. FHA loans have more lenient guidelines on collections and/or charged-off accounts than VA loans.

FHA Versus VA Loans on Automated Underwriting System Approval

Borrowers who cannot get an automated approval per AUS due to large unpaid collections and/or charged-off accounts can see if they can get an approve/eligible per AUS on FHA loan AUS. Sometimes FHA loans versus VA loans can be an option for borrowers with bad credit and large collections/charged-off accounts. This is called overlays on collections and charged-off accounts on VA loans. Non-QM Mortgage Brokers has no mortgage overlays on VA Home Loans. We just go off VA Guidelines and Overlays do not exist.

VA Mortgage Process

Often many borrowers who are Veterans with a Certificate of Eligibility are told by lenders that they cannot qualify for a VA Loan without having a credit score of at least 620. Other lenders turn Veterans down because they tell them that VA has a minimum credit score of 640. Veterans with a valid COE can qualify for VA Loans With 580 Credit Scores. This is not the case.

VA Loans With Poor Credit

The United States Department of Veteran Affairs, VA, has one of the most lenient mortgage guidelines out of all mortgage programs in the Country. VA realizes that Veterans often do not have the best of credit, especially due to transfers that can happen several times per calendar year as well as deployment. During wartime, it is often difficult to worry about paying their minimum monthly debts overseas and injuries are often common while serving in the United States Military.

Qualify And Get Pre-Approved Today. Click here!

About The Department Of Veterans Affairs

The United States Department Of Veterans Affairs is not a mortgage lender and does not originate, fund, or service VA Loans. The Veterans Administration insures residential home loans that private mortgage lenders make to United States Veterans who meet the VA Guidelines.

In the event, that the Veteran borrower was to default on his or her VA loan, the Veterans Administration will insure that mortgage lender against the defaulted and/or foreclosed VA loan This VA guaranty makes it extremely desirable for private lenders to fund VA Loans due to little to no risk due to the insurance and guarantee by the federal government against losses on VA Loans.

How Can I Qualify For VA Loans With 580 Credit Scores?

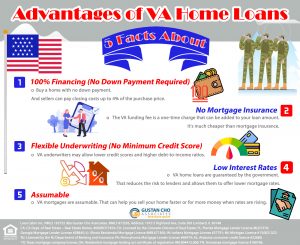

One of the greatest benefits our government gives our Veterans for serving our country and has received an honorable discharge is a Certificate of Eligibility to qualify for VA loans. There are many benefits to having VA loans. There are no down payment requirements on VA loans.

VA Funding Fees on VA Loans

There is a VA Funding Fee. The VA Funding Fee can be rolled into the VA loan. There is no need for money out of pocket by the Veteran for the down payment. Veterans Affairs no longer has a maximum VA Loan Limit on VA loans.

Not only does VA has no money-down requirement with 100% financing with no maximum loan limit, but there is no mortgage insurance on VA loans. The VA does not have maximum loan limits so you can buy a high-end home with VA loans.

Closing Costs on VA Home Loans

There are closing costs on all home purchases and refinances. However, on purchases, VA allows the home seller to give the home buyer up to a 4.0% seller concession toward the home buyer’s closing costs. If the veteran home buyer is short on closing costs or if the home seller is not willing to give a seller concession, the Veteran can get a lender’s credit to cover part or all of the closing costs.

There is no mortgage insurance premium on VA loans. Bottom line is that a Veteran with a COE does not need a penny to purchase a home with a VA Loan.

Qualify And Get Pre-Approved Today. Click here!

VA Loans With 580 Credit Scores Guidelines

Qualifying for VA Loans with 580 Credit Score is no problem at all. VA credit requirements are extremely lenient. However, Mortgage Lenders are not expected to abide by the minimum VA Credit Guidelines. Lenders do have to meet the minimum VA Lending Guidelines.

Mortgage lenders can set higher standards of their own which are called Lender Overlays. Most Mortgage Lenders will set a minimum credit score requirement of at least 620 Credit Score or higher. There are lenders like Non-QM Mortgage Brokers that will approve Veterans for VA Loans with 580 credit scores and sometimes lower.

Automated Underwriting System Approval on VA Loans With 580 Credit Scores

Here are VA Credit Requirements:

- VA does not have a mandatory minimum credit score requirement

- VA lets the lender set the minimum credit score requirement

- Most lenders who are approved by the VA to originate and close on VA Loans have Lender Overlays on Credit Scores on VA Loans

- Lender Overlays are the individual lender’s requirement which is above and beyond those of the Department of Veterans Affairs

- Most lenders will set lender overlays on credit scores at 620 to 640

- Non-QM Mortgage Brokers has no lender overlays on VA loans

- VA does not have a maximum debt-to-income ratio requirement

I recently got an approve/eligible per Automated Underwriting Approval Findings on a borrower with a 552 credit score and a 58% debt-to-income ratio.

Qualify And Get Pre-Approved Today. Click here!

VA Loans With 580 Credit Scores After Bankruptcy And Housing Event

There are waiting periods after bankruptcy and/or housing event to qualify for VA loans. There is a 2-year waiting period to qualify for a VA mortgage loan after a Chapter 7 Bankruptcy. There is a 2-year waiting period after the housing event. The start date of the waiting period is the date of the prior short sale date on a short sale. The start date of the waiting period on a foreclosure is the recorded date of the foreclosure and/or deed in lieu of foreclosure

If you have deferred student loans that are deferred for at least 12 or more months, you will be exempt from debt-to-income ratio calculations. Again, VA loans are one of the easiest mortgage loan programs to qualify for. However, not all can qualify for VA loans. Only the men and women who have served in the United States Armed Services with a valid Certificate of Eligibility can qualify for this great loan program.

Qualify And Get Pre-Approved Today. Click here

Lender That Specializes In VA Loans With 580 Credit Scores With No Overlays

I get countless calls from Veterans who shop for VA loans with 580 credit scores. Many are told that they qualify for FHA but not VA loans with 580 Credit Scores. Again, this is not the requirement of the Veterans Administration BUT because the lender went to have lender overlays. There is no reason why a Veteran who can qualify for an FHA loan cannot qualify for a VA loan.

Why Can Veterans Qualify For FHA Loans But Not VA Loans?

Veteran Borrowers were told NO on a VA Loan BUT Yes on an FHA loan, please contact us at Non-QM Mortgage Brokers As long as borrowers can get approve/eligible per the Automated Underwriting System and can clear the conditions on the AUS, we will close on the VA loan with no lender overlays. We have a national reputation for closing VA loans in 21 days from the date e-Disclosures are signed on VA loans. Veteran borrowers need to consult with a national VA direct mortgage lender that specializes in VA Loans with no lender overlays, contact us at Non-QM Mortgage Brokers at the contact information below:

Toll-Free: 800 900 8569 or email us at gcho@gustancho.com

Qualify And Get Pre-Approved Today. Click here