Gift Of Equity Mortgage Guidelines When Buying Home At Discount

Non-QM Mortgage Brokers have no lender overlays on the gift of equity mortgage guidelines when buying a home at a discount from a family member. John Strange of Non-QM Mortgage Brokers, a gift of equity home purchase expert, defines gift of equity as follows:

A gift of equity is when a homebuyer purchases a home from a family member at a discount. The discount is the gift of equity. The seller, a family member, is gifting the equity to the homebuyer.

We can help you qualify for purchase when buying a home at a discount from a family member with a gift of equity. Apply NOW at Non-QM Mortgage Brokers and leave it to us. In today’s ever-so-changing mortgage market, we are seeing more and more cases where gifts of equity come into play.

Gift of Equity Mortgage Guidelines: Gifting Equity To Family By Selling Home at Discount

It is a very complicated topic, and there are specific guidelines for this process. In short, a gift of equity is a gift the seller provides to the buyer in the form of the property’s existing equity. This is usually a transaction with a family member. In this blog, we will go over how to buy a home from a family member with no or little down payment.

When a parent uses the equity in their home as the form of the down payment for the buyer, typically, that would be one of their children. Theoretically, they give up their profits from selling and gifting the property to the buyer. We will dive into this topic in more detail. Since a parent selling the house to their children is the most common use of a gift of equity, let’s go over an example now.

How Closing Costs Factor Into Gift of Equity?

When using a gift of equity, you may also incorporate seller concessions. Seller concessions allow for 3% of the purchase price with conventional financing and up to 6% with FHA loans or 4% with VA financing. To piggyback off the example above, Bob’s parents could give him $45,000 as a gift of equity and add $5,000 of seller concessions to the sales contract. This will now give Bob $5,000 for loan costs, creating a low out-of-pocket money transaction. Sometimes, you can gift the home, and the buyer may not need to bring any money to the closing. In theory, he can now finance the loan’s costs.

How Does Gift of Equity Mortgage Loan Work?

The gift of equity loan does not work. Under gift of equity mortgage guidelines, a gift of equity cannot be a loan and can only be a gift. A gift letter from the mortgage lender will be required.

The homebuyer needs to have the seller complete a gift of equity form. The seller and donor of the gift of equity need to sign and date the gift of equity form. The lender will provide the gift letter in their own gift of equity letter format.

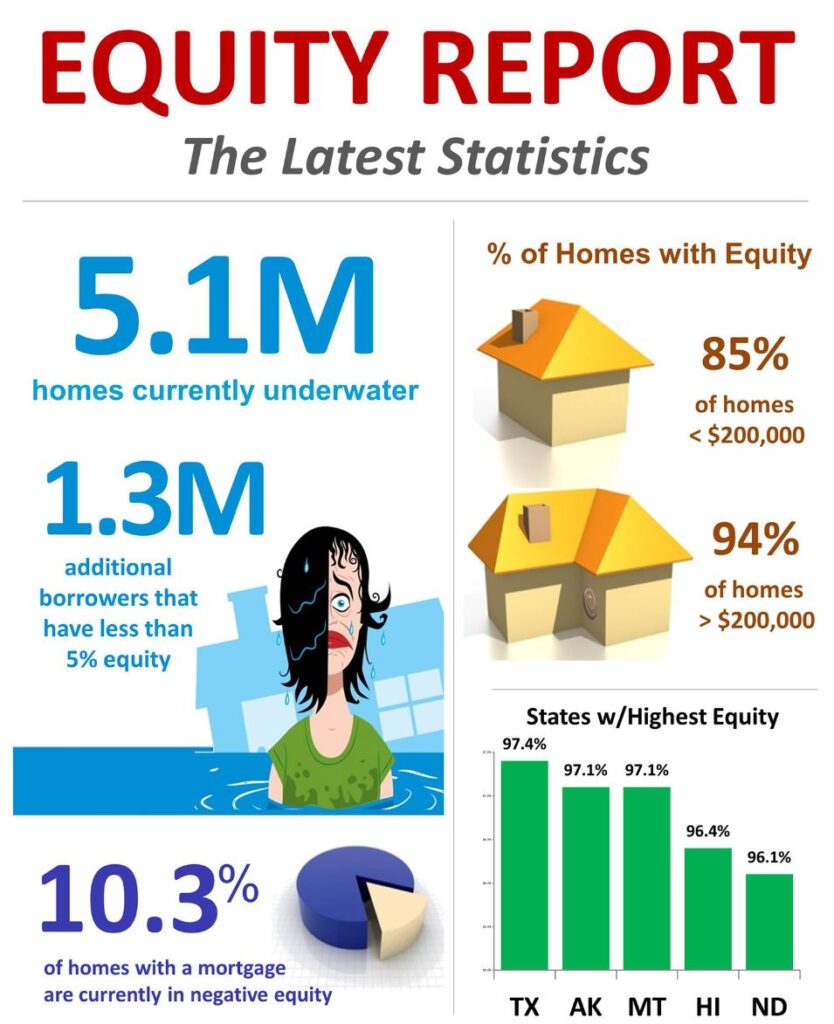

Gift of equity mortgage guidelines specifies that for the gift of equity mortgage to work, sellers must have equity in the home they sell at a discount.

How Is Equity Determined

An appraisal will be completed as part of the loan process. For the example above to work, the house must appraise for at least $300,000. If the home appraisal comes in low, the gift of equity must be lowered or removed.

Just know that equity must be real to give as a gift. Assuming the equity is in the property, the process is very similar to a regular mortgage loan.

There will still be required documentation such as proof of rental payments, income documentation, proof of assets, etc. Any documentation for a regular mortgage loan will be needed. If you rent the house from a family member, proof of rental payments will be necessary to build a housing tradeline. Showing on-time rental payments is one way to strengthen borrowers’ loan applications.

Gift of Equity Mortgage Guidelines of Acceptable Eligible Donors

One of the most confusing aspects of the gift of equity process is determining an acceptable donor. You must be related to giving a gift of equity. Now in today’s modern world, a relative can mean many things. Here is the definition of the gift of equity:

The gift of equity is defined as “the borrower spouse, child, or another dependent, or by any other individual who is related by blood, adoption, barrage, or legal guardianship semicolon or a fiancé, or domestic partner.”

Hopefully, that clears up any confusion—the gift of equity mortgage guidelines on who is classified as a relative is set in stone.

Gift of Equity Mortgage Guidelines For Buyers and Sellers

The gift of equity process can favor both the seller and the buyer. The buyer comes out ahead on the deal as they do not need to put down a down payment. And the seller gets the satisfaction of helping a relative. The seller can give the American dream to one of their relatives.

The team at Non-QM Mortgage Brokers are experts in gift of equity transactions. Non-QM Mortgage Brokers are mortgage brokers licensed in 48 states, including Washington, DC, Puerto Rico, and the U.S. Virgin Islands.

If a gift of equity is something you think may suit you, please call us directly. Borrowers can contact us at Non-QM Mortgage Brokers or text us for a faster response. Or email us at gcho@gustancho.com. We specialize in conventional, FHA, VA, and USDA financing without any LENDER OVERLAYS. If the gift of the equity process is not for you, I encourage you to check out our other blogs on related topics. Since we do not have any lender overlays, many of our Barbers utilize gift funds to purchase their new homes. We are always here to help with any mortgage-related questions, seven days a week!